Nick Goold

Are you getting your entry timing right? One of the most common reasons for making a loss is incorrect entry timing. By ensuring the correct timing of your market entries, you can reduce risk and increase profits at the same time. As a strategy for better timing your market entry, we will introduce a technique that uses two charts.

How to time your entry using two charts

To time your trades better, look at a second, shorter interval chart in addition to the main chart you would normally use. When scalping, for example, a 5-minute chart is commonly used as the main chart with a 1-minute chart to look for better entry points. For day trading, if the 60-minute chart is used as the main chart, the 5-minute chart can be added.

By doing so, you'll see a 10-period moving average on each chart. When using moving averages, if the parameter values are too small, it's easy to get more false trade signals, and you could be in danger of overtrading. Conversely, if the parameter value is too large, trade entries are missed because of entry signal delays.

When using two charts, you will notice that the moving average signals on each chart are often different. In such cases, it is best to be guided by shorter-term price movements.

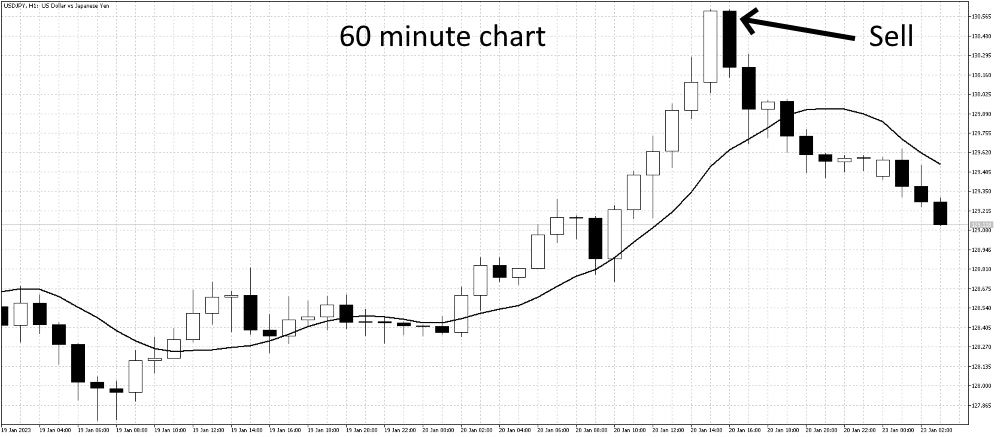

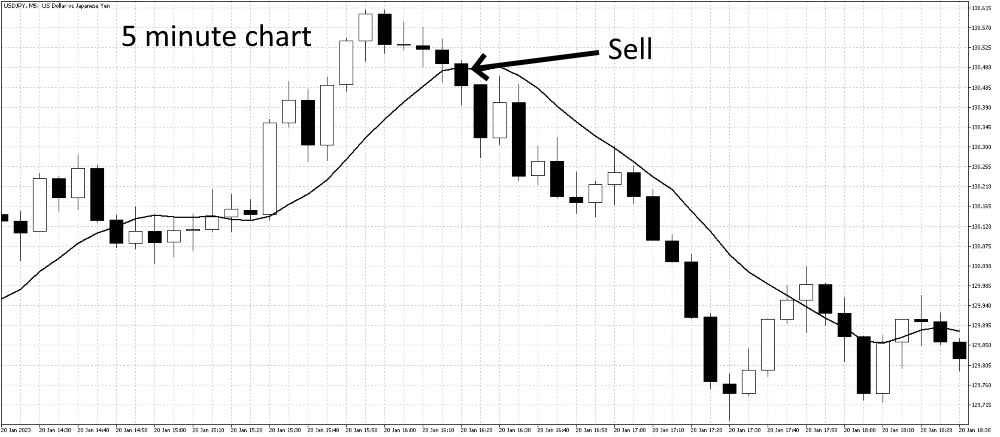

Example 1.

First, we check the market conditions on each of the two charts. In the 60-minute chart below, the price is significantly above the moving average and has begun to fall. That indicates an opportunity for a reversal sale. So, to measure the entry timing, we check the state of the shorter 5-minute chart, which also begins to show a reversal movement. This confirms the timing is good for a reversal sale. Alternatively, if the 5-minute chart had not yet shown this move, it would mean that it's not good timing for the entry on a reversal sale.

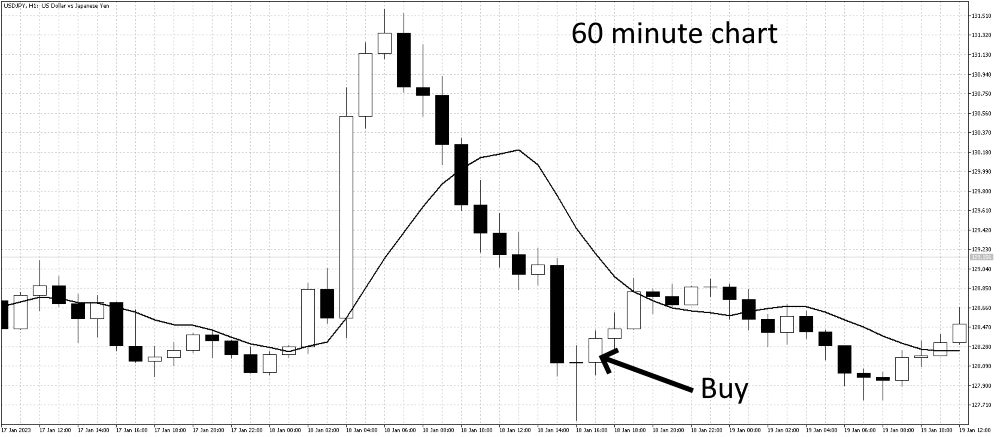

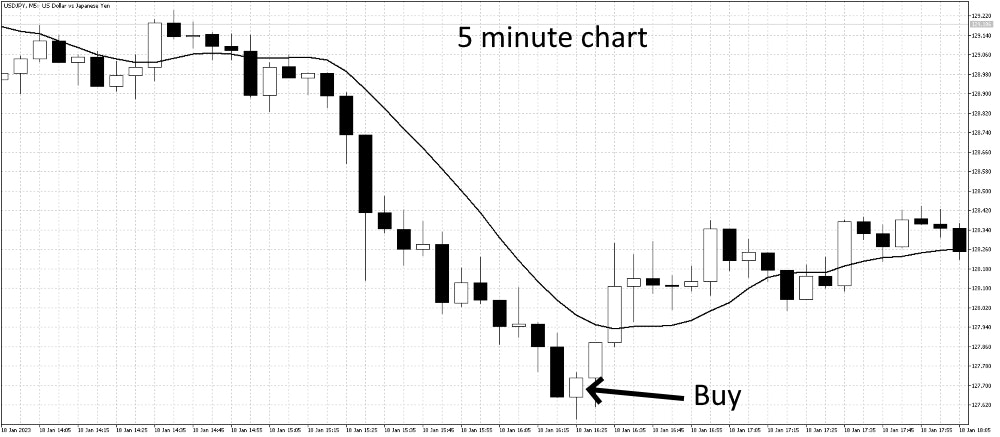

Example 2.

As in the first Example, check the market situation on each of the two charts. In the case of the chart below, the 60-minute chart shows that the price has diverged significantly below the moving average, indicating an oversold condition. The price has then just started to rise back to the moving average. This is an opportunity to buy entry. To time the entry, we check the 5-minute chart, which shows that the downward moving average has turned sideways and the price has crossed above the moving average. This timing is an excellent buy-entry opportunity. As in this case, the trading strategy is to wait for the shorter time chart to rise and see the longer time interval chart rise also.

Improve your entry timing using two charts. As in these examples, requires practice and some experience. You'll need lots of practice to read charts well. As well as technical analysis, analysing market news and market sentiment is also important and requires experience. It is very difficult to make profits from technical analysis alone, as the market moves in different ways depending on news and sentiment.