Nick Goold

The US non-farm payroll and employment statistics are economic indicators released by the Department of Labour on the first Friday of every month. They show the change in the number of people employed over the previous month, excluding the agricultural sector.

So why are the US employment statistics so important?

The change in non-farm payrolls, along with other reports included in the overall Employment Report, is generally used as an indication of the strength and future direction of the economy. A growing labour market means more people earning income, and more income generates more spending, creating a virtuous cycle in the economy. The change in non-farm payrolls can be more important than the GDP results, which is one of the other important measures of economic strength.

The FED's (US Central Bank) mandate is to maximise employment and maintain price stability. When changing or deciding on interest rates, it looks carefully at the employment figures. If the employment figures are healthy, interest rates may need to rise to avoid the economy overheating and prices increasing. Conversely, if the employment figures are poor, interest rates may need to be lowered to make it easier for companies to create new jobs and stimulate the economy.

A higher-than-expected employment figure is positive for the US dollar. Conversely, a lower-than-expected employment report is usually negative for the US dollar. It's also important to check the revised figures for the previous month's employment figures. These are published at the same time. For example, a result of 150 000 new jobs compared to the forecast of 140 000 new jobs would be considered bullish (positive) for the US dollar. However, if the 120 000 new jobs figure released the previous month is revised downwards to 95 000, this would be a turnaround and weaken the US dollar.

_oslxr.jpg?fm=pjpg&auto=format)

How to trade during the jobs report

When the US jobs report is released, all markets usually have significant volatility. In addition, the computers used in system trading react to the news instantly and repeatedly trade in the midst of violent price movements. Immediately after the news is announced, price movements are so intense that position settlements can be executed a long way from where they were ordered.

Price movements after the announcement will also vary depending on how much the figures differ from expectations. Whatever the outcome, volatility will be higher than normal, increasing the likelihood of slippage. It's therefore wise to close all positions prior to the employment figures announcement.

If you still want to trade in time for the jobs report, set smaller lot sizes than usual and larger stops and targets than usual. It is generally best to wait and refrain from trading until the market has calmed down.

Three trading strategies for using news announcements

Strategy 1) Entry following the announcement

This strategy involves trading in quick reaction to the announcement. For example, if the result is announced as 175,000 versus 150,000 jobs, immediately enter a buy entry in USDJPY.

Strategy 2) Entry against the content of the announcement

If you believe the market is overreacting to the price movement, trade against the announcement result. Suppose the announcement result figures are better than expected and the market is too far up. In that case, we will initiate a sell entry.

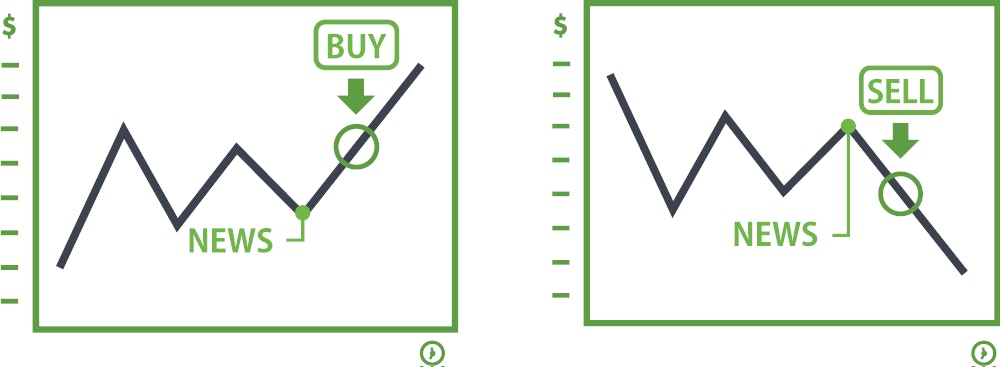

Strategy 3) Entry after the initial reaction to the announcement has abated

However, be aware that if the market moves too much, it can become difficult to even enter a trade (this is known as a 'fast market'). It's also possible for a new trade entry to end in a large loss in just a matter of seconds. Even if you spot the danger, it can be impossible to get out in time. Therefore, it's wiser to enter the market after the major initial movement has calmed down. Trade when it's clear whether the trend has been changed by the new figures and revisions to past data.