Nick Goold

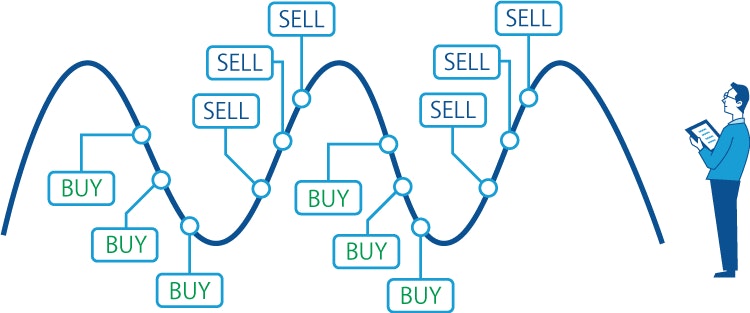

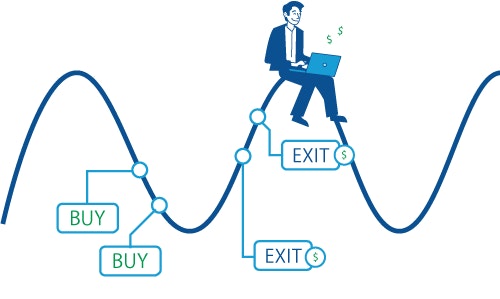

Averaging down is a trading strategy used by many traders and investors. When the price of stock drops after you buy it, you do not exit with a loss but instead, buy more. By repeating this process several times, the average purchase price becomes lower. In the case of selling, instead of realizing the loss, you increase the average price by selling more.

Advantages of averaging down

You can offset your losing trades with winning trades, putting less pressure to get your trade timing right. In range market conditions, an averaging down strategy can be very effective.

Disadvantages of averaging down

It can be difficult to stop adding to your losing positions, as there is always the hope that the market will reverse. When the market trend is strong, losses will grow large. In the worst-case scenario, your account balance can go to zero. Even if the market reverses, adding to your position too often reduces the chance of earning a profit.

Average down trading strategy advice

Advice 1

Although average down is a good trading technique when used successfully, it can result in losses when the market enters a strong trend. Using an average down strategy can be difficult, so it is advisable to establish trading rules and strictly follow them. Averaging down is not suitable for all market conditions.

Advice 2

Consider your risk-to-reward ratio when you use average down. If the price returns to the entry price, resist the temptation to exit with a small profit. Setting your risk reward above 1 (average win greater than average loss) is difficult when using an average down strategy but vital.

Advice 3

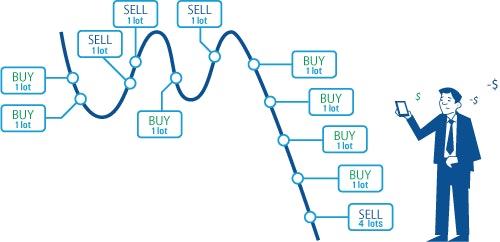

Although the win rate is higher when you use an average down strategy, the number of positions and losses will increase. Set a maximum stop-loss amount per trade, and always follow your rules. The key to trading is to limit losses, as losses are difficult to recover.

Advice 4

When using an average down strategy, determine the maximum number of positions you are willing to open. It is dangerous if you do not decide this in advance, as your losses can wipe out your account. Adding to your position up to three times is acceptable, but be careful not to add more than five times as the risk level increases dramatically.

Advice 5

Do not use an average down strategy when economic indicators are released. Economic indicator announcements increase volatility, and prices may go in one direction and not return for a long time.