Aayush Jindal

Key Highlights

- The Euro failed to hold the 1.1280 support andrecently declined against the US Dollar.

- EUR/USD traded below a key bullish trend linewith support at 1.1280 on the 4-hours chart.

- The US nonfarm payrolls in June 2019 increased224K, more than the 160K forecast.

- Germany’s Industrial Production in May 2019(MoM) could slide 0.4%, less than the last -1.9%.

EURUSD Technical Analysis

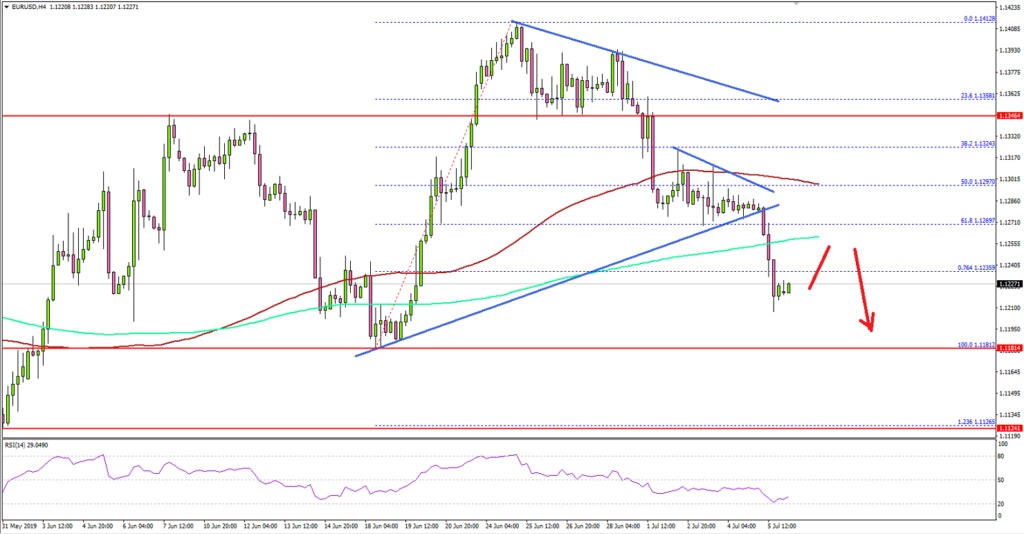

After trading above the 1.1400 level, the Euro struggled to continue higher against the US Dollar. As a result, the EUR/USD pair started a fresh decrease and broke the 1.1350 and 1.1300 support levels.

Looking at the 4-hours chart, the pair traded below a coupleof important support near the 1.1300 level plus the 100 simple moving average(red, 4-hours). The pair even broke the 50% Fib retracement level of the upwardmove from the 1.1181 low to 1.1412 high.

Moreover, the pair traded below a key bullish trend linewith support at 1.1280 on the same chart. It opened the doors for more lossesbelow the 1.1250 level plus the 200 simple moving average (green, 4-hours).

Finally, the pair traded below the 76.4% Fib retracementlevel of the upward move from the 1.1181 low to 1.1412 high. Therefore, thereare high chances of more losses below the 1.1200 and 1.1180 support levels.

Conversely, if there is an upside correction, the last keysupport near the 1.1280 level plus the 100 simple moving average (red, 4-hours)are likely to act as a strong barrier. Only a successful close above the 1.1300level could start a fresh increase.

Fundamentally, the US nonfarm payrolls report for June 2019was released by the US Department of Labor. The market was looking for anincrease of 160K in June 2019, better than the last 75K.

The actual result was well above the market expectation, asthe US nonfarm payrolls increased by 224K. However, the last reading wasrevised down from 75K to 72K. More importantly, the Unemployment rate increasedfrom 3.6% to 3.7%.

The report added:

Among the major worker groups, the unemployment rates for adult men (3.3 percent), adult women (3.3 percent), teenagers (12.7 percent), Whites (3.3 percent), Blacks (6.0 percent), Asians (2.1 percent), and Hispanics (4.3 percent) showed little or no change in June.

Overall, EUR/USD and GBP/USD might continue to face selling interest and a decent recovery might be difficult in the short term.

Economic Releases to Watch Today

- Germany’s Industrial Production for May 2019(MoM) - Forecast -0.4%, versus -1.9% previous.

- Germany’s Trade Balance for May 2019 - Forecast€18.6B, versus €17.0B previous.

- Germany’s Imports of goods and services May 2019- Forecast -0.2%, versus -1.3% previous.

- Germany’s Exports of goods and services May 2019- Forecast 0%, versus -3.7% previous.