Aayush Jindal

Key Highlights

- The British Pound declined heavily and traded toa new 2-year low against the US Dollar.

- GBP/USD struggled to break a crucial bearishtrend line with current resistance near 1.2440 on the 4-hours chart.

- UK’s Consumer Credit in June 2019 came in at£1.046B, up from the last revised £0.906B.

- The US Personal Income in June 2019 couldincrease 0.4% (MoM), less than the last 0.5%.

GBPUSD Technical Analysis

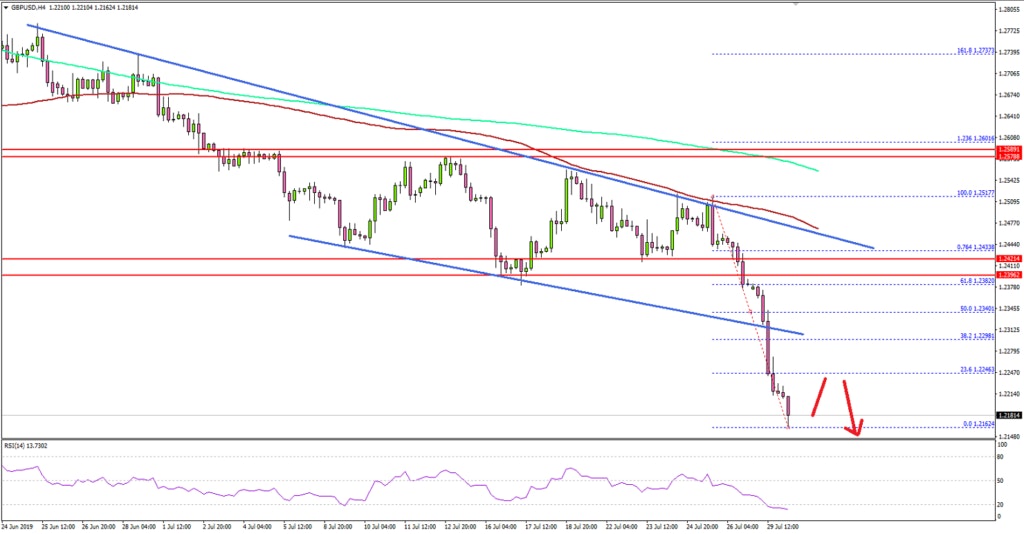

The British Pound started a strong downward move in July 2019 against the US Dollar. The GBP/USD pair broke the key 1.2650 and 1.2520 support levels to enter a bearish zone.

Looking at the 4-hours chart, the pair remained in a bearishzone below 1.2520 in the past few days and followed a negative structure. Moreimportantly, the 100 simple moving average (red, 4-hours) extended its bearishmoves.

Recently, the pair failed to break a crucial bearish trendline with current resistance near 1.2440 and the 100 simple moving average(red, 4-hours). As a result, there was a sharp decline below the 1.2420 and1.2400 support levels.

The pair even broke the 1.2300 level and traded to new 2-yearlow below 1.2200. It seems like the pair is under a lot of pressure and itcould continue to slide towards the 1.2120 support.

On the upside, there are many resistances near the 1.2300and 1.2350 levels. The main resistance is near 1.2420-1.2440 area, the samebearish trend line, and the 100 SMA.

Therefore, an upside correction in GBP/USD is likely to facea strong selling interest near 1.2400 in the coming days.

Fundamentally, the UK Consumer Credit report for June 2019was released by the Bank of England. The market was looking for the additionalamount borrowed by consumers to buy goods and services in June 2019 to bearound £0.900B.

The actual result was above the market forecast, as theamount was £1.046B, up from the last revised £0.906B. Moreover, the netmortgage borrowing by households came in at £3.7 billion, which is around the averageof the previous three years.

The report added:

Borrowing from banks increased by £2.5 billion in June. During the first half of 2019, borrowing has been stronger than the same period in 2018, and the annual growth rate has, therefore, risen.

Overall, the US Dollar is likely to extend gains and any recovery in EUR/USD and GBP/USD could face a strong selling interest in the near term.

Economic Releases to Watch Today

- Euro Zone Business Climate Index for July 2019 –Forecast 0.10, versus 0.17 previous

- German CPI for July 2019 (YoY) (Prelim) –Forecast +1.5%, versus +1.6% previous.

- German CPI for March 2019 (MoM) (Prelim) –Forecast +0.3%, versus +0.3% previous.

- US Personal Income for June 2019 (MoM) -Forecast +0.4%, versus +0.5% previous.

- US Consumer Confidence April 2019 - Forecast 125.0,versus 121.5 previous.