Aayush Jindal

Key Highlights

- Crude oil price declined sharply below the $110 support.

- It traded below a bullish trend line with support near $114.50 on the 4-hours chart.

- Gold price is consolidating below the $1,850 pivot level.

- The US Manufacturing PMI could decline from 57 to 56 in June 2022 (Prelim).

Crude Oil Price Technical Analysis

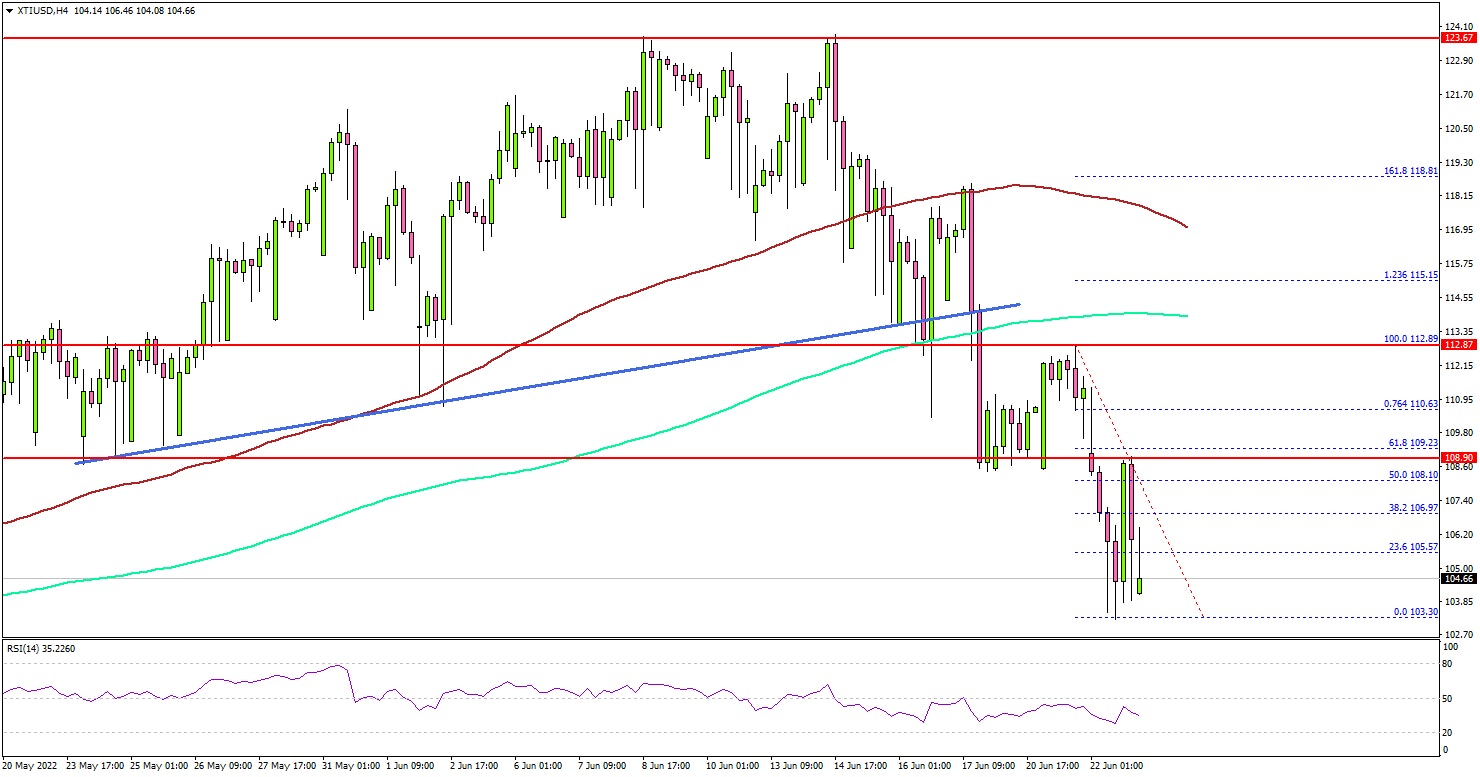

After struggling to clear the $125 resistance zone, crude oil price started a fresh decline against the US Dollar. The price broke the $115.00 support to enter a short-term bearish zone.

Looking at the 4-hours chart of XTI/USD, there was a break below a bullish trend line with support near $114.50. The price even settled below the $110.00 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The bears pushed the price below the $105.00 level. If they remain in action, there is a risk of a move towards the $100.00 support.

The next major support is near $98.00. The main support sits near $95.50, below which there is a risk of a move towards the $92.50 level. Any more losses might call for a test of the $88.00 support.

On the upside, the previous support at $107.50 might act as a resistance. The next major resistance is near $112.50, above which the price could accelerate higher towards the $115.00 level.

Looking at the gold price, the price is struggling to clear the $1,850 zone. A close above $1,850 might start a major increase.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for June 2022 (Preliminary) - Forecast 54.0, versus 54.8 previous.

- Germany’s Services PMI for June 2022 (Preliminary) - Forecast 54.5, versus 55.0 previous.

- Euro Zone Manufacturing PMI June 2022 (Preliminary) – Forecast 53.9, versus 54.6 previous.

- Euro Zone Services PMI for June 2022 (Preliminary) – Forecast 54.5, versus 55.0 previous.

- UK Manufacturing PMI for June 2022 (Preliminary) – Forecast 53.7, versus 54.6 previous.

- UK Services PMI for June 2022 (Preliminary) – Forecast 53.0, versus 53.4 previous.

- US Manufacturing PMI for June 2022 (Preliminary) – Forecast 56.0, versus 57.0 previous.

- US Services PMI for June 2022 (Preliminary) – Forecast 53.5, versus 53.4 previous.

- US Initial Jobless Claims - Forecast 227K, versus 229K previous.