Aayush Jindal

Key Highlights

- EUR/USD is attempting a recovery wave from the parity support.

- A key bearish trend line is forming with resistance near 1.0150 on the 4-hours chart.

- GBP/USD could rise if there is a proper close above the 1.2000 resistance.

- Gold price extended losses and traded below the $1,720 support.

EUR/USD Technical Analysis

The Euro started a major decline from well above the 1.0250 zone against the US Dollar. EUR/USD even broke the 1.0100 support and spiked below the parity level.

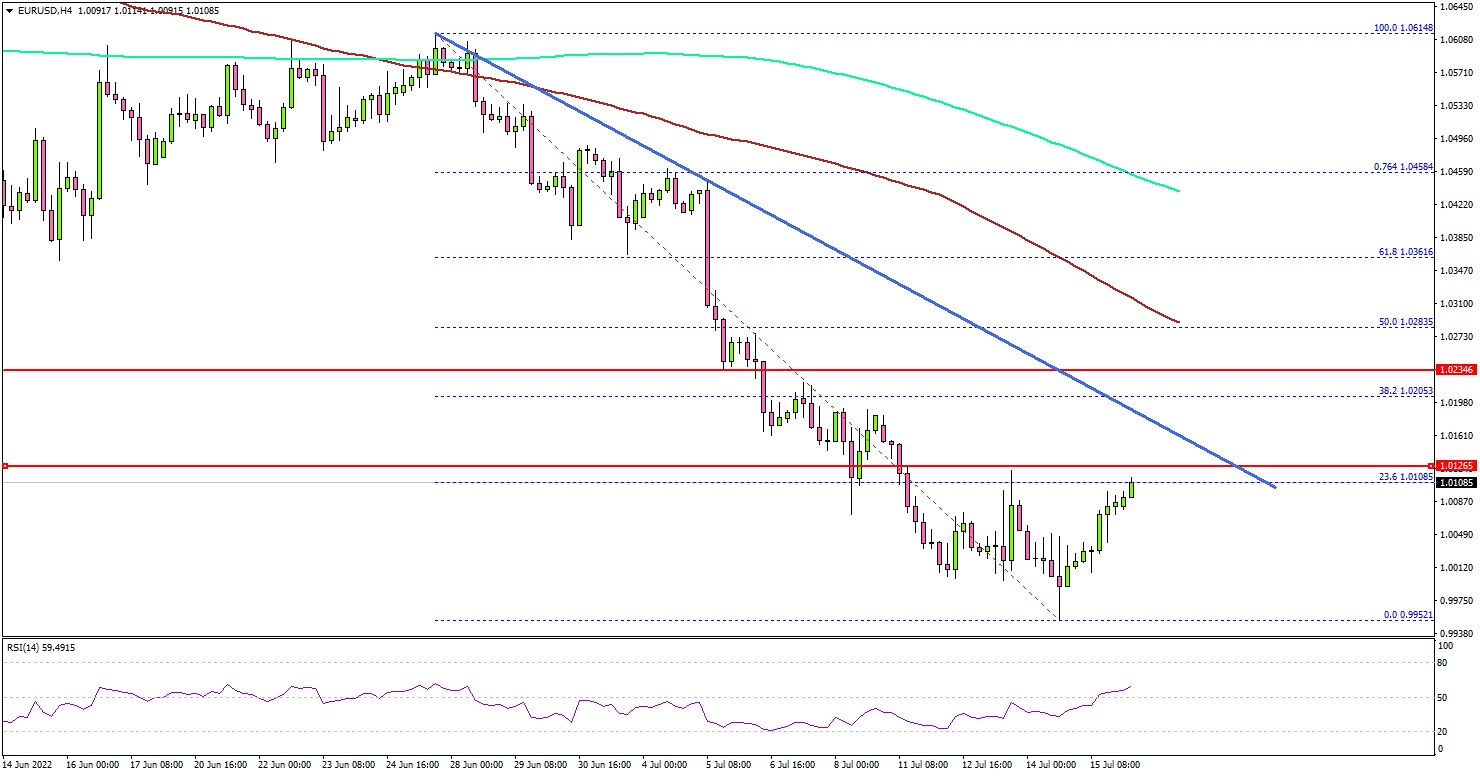

Looking at the 4-hours chart, the pair even traded as low as 0.9952. It settled well below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, there was an upside correction above the parity level. The pair climbed above the 1.0050 resistance level. It is now facing resistance near the 1.0110 level or the 23.6% Fib retracement level of the downward move from the 1.0614 swing high to 0.9952 low.

There is also a key bearish trend line forming with resistance near 1.0150 on the same chart. If there is an upside break, the pair could rise towards 1.0200.

The next major resistance could be near the 1.0280 level and the 100 simple moving average (red, 4-hours). It is near the 50% Fib retracement level of the downward move from the 1.0614 swing high to 0.9952 low.

If there is no upside break, the pair could correct lower and dip below 1.0000. The next major support is 0.9950, below which the pair could resume its downtrend.

Looking at GBP/USD, the pair also started an upside correction from the 1.1760 zone but might face hurdles near the 1.2000 zone.

Economic Releases

- US NAHB Housing Price Index for July 2022 (MoM) - Forecast 68, versus 67 previous.