Aayush Jindal

Key Highlights

- EUR/USD is facing a major hurdle near 1.0225.

- A key bearish trend line is forming with resistance near 1.0230 on the 4-hours chart.

- GBP/USD could recover if there is a clear move above 1.2050.

- Crude oil price is sliding and trading below $100.

EUR/USD Technical Analysis

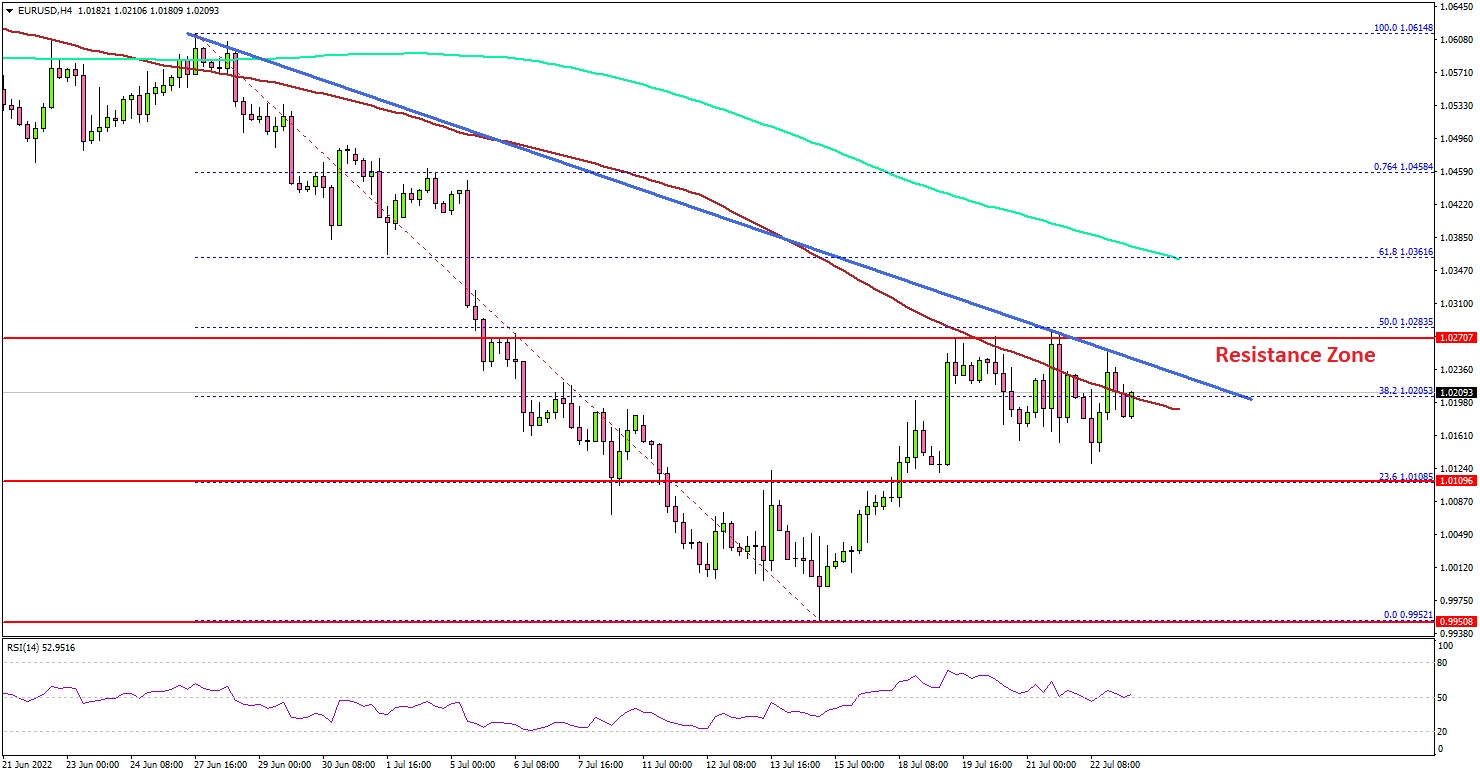

The Euro started an upside correction from the 0.9950 zone against the US Dollar. EUR/USD is back above 1.0150 but now faces a few important hurdles.

Looking at the 4-hours chart, the pair was able to recover losses and climbed above the 1.0100 and 1.0150 resistance levels. The bulls pushed the pair above the 38.2% Fib retracement level of the downward move from the 1.0614 swing high to 0.9951 low.

However, the pair is now facing hurdles near 1.0225 and the 100 simple moving average (red, 4-hours). There is also a key bearish trend line forming with resistance near 1.0230 on the same chart.

The next major resistance is near the 1.0280 level. It is near the 50% Fib retracement level of the downward move from the 1.0614 swing high to 0.9951 low. A close above the 1.0280 level could open the doors for a steady increase.

The next major resistance could be near the 1.0360 level, above which the pair could rise to 1.0420. If there is no upside break, the pair could correct lower and dip below 1.0180.

The next major support is 1.0150, below which the pair could resume its decline. In the stated case, the pair might decline towards the 1.0110 level.

Looking at crude oil price, the bulls faced hurdles near the 103.00 zone and recently started a fresh decline below the $100 level.

Economic Releases

- German IFO Business Climate Index for July 2022 – Forecast 90.5, versus 92.3 previous.

- German IFO Current Assessment Index for July 2022 - Forecast 98.2, versus 99.3 previous.

- German IFO Expectations Index for July 2022 – Forecast 83, versus 85.8 previous.