Aayush Jindal

Key Highlights

- Gold price is struggling to recover above $1,740.

- A major bearish trend line is forming with resistance near $1,725 on the 4-hours chart.

- EUR/USD and GBP/USD started an upside correction.

- Crude oil price attempted an upside break above the $102.50 resistance.

Gold Price Technical Analysis

Gold price started a major decline from well above the $1,835 level against the US Dollar. The price declined below the $1,780 and $1,760 support levels.

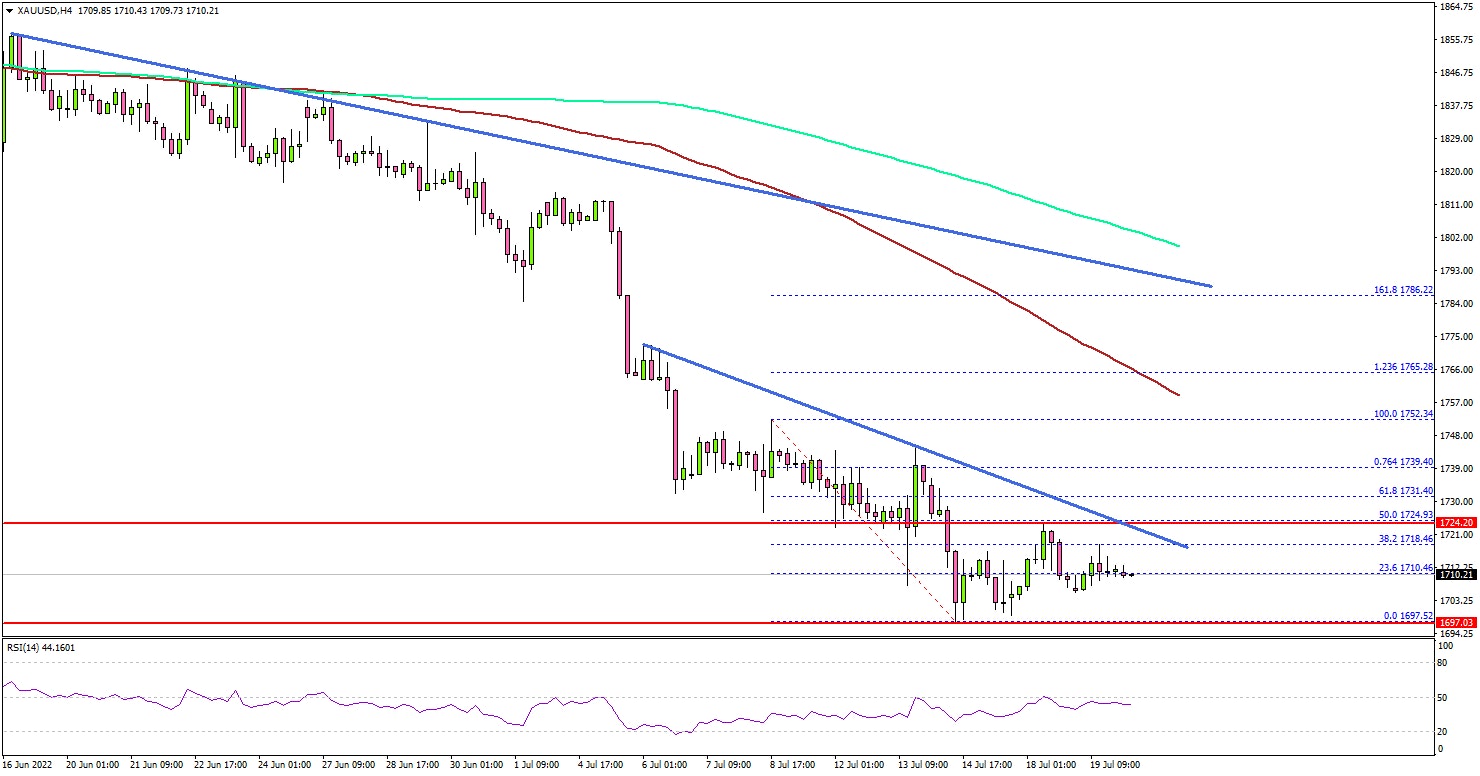

The 4-hours chart of XAU/USD indicates that the price traded below the $1,740 support, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

It even spiked below the $1,700 level and traded as low as $1,697. It is now consolidating losses near the $1,710 level. An immediate resistance is near the $1,725 level. There is also a major bearish trend line forming with resistance near $1,725 on the same chart.

The next major resistance is near the $1,740 level, above which the price could rise towards the 100 simple moving average (red, 4-hours).

If there is no upside break, the price could continue to move down below $1,700. The next major support is near the $1,685 level, below which the price could accelerate lower. In the stated case, the price may perhaps decline towards the $1,650 level.

Looking at EUR/USD, the pair started a recovery wave and surpassed 1.0200. Similarly, GBP/USD climbed above the 1.2000 resistance zone.

Economic Releases to Watch Today

- UK Consumer Price Index for June 2022 (YoY) – Forecast +9.3%, versus +9.1% previous.

- UK Core Consumer Price Index for June 2022 (YoY) – Forecast +5.8%, versus +5.9% previous.

- Canadian Consumer Price Index for June 2022 (MoM) – Forecast +2.6%, versus +1.7% previous.

- Canadian Consumer Price Index for June 2022 (YoY) – Forecast +8.4%, versus +7.7% previous.