Aayush Jindal

Key Highlights

- Gold price remains in a strong uptrend above the $1,680 support zone.

- A major bullish trend line is forming with support at $1,696 on the 4-hours chart of XAU/USD.

- The Fed interest rate decision will be announced later today (forecast – no change from 0.25%).

- The US GDP is likely to decline 4% in Q1 2020 (Preliminary).

Gold Price Technical Analysis

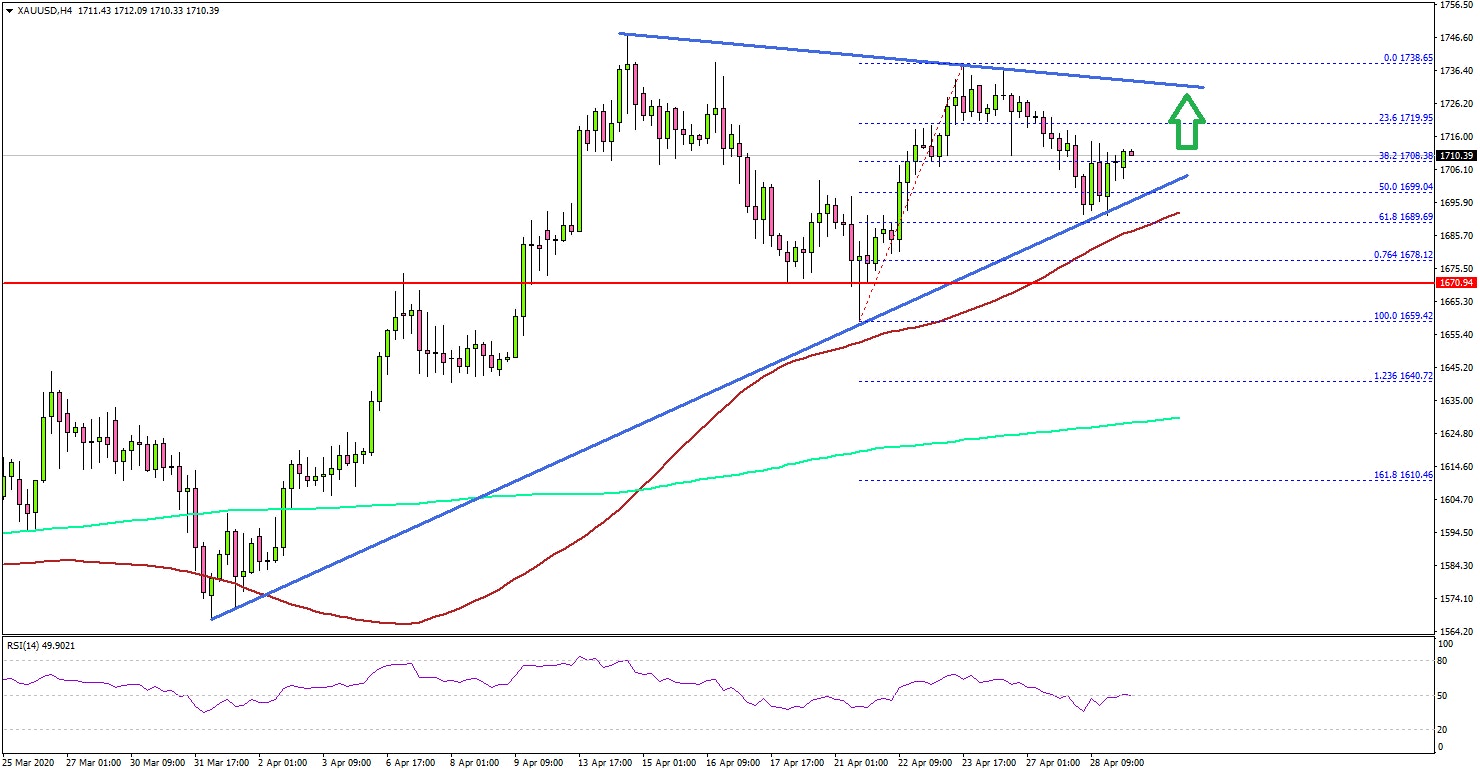

Earlier this month, gold price traded to a new multi-year high at $1,747 before correcting lower against the US Dollar. However, the price remains in a strong uptrend above the $1,680 support zone.

The 4-hours chart of XAU/USD indicates that the price corrected lower sharply from $1,747 and even spiked below the $1,680 support. It traded as low as $1,659 before starting a fresh increase.

It seems like the price found support near the 100 simple moving average (red, 4-hours). It jumped back above $1,700 and traded as high as $1,738 before another correction.

There was a drop close to the 61.8% Fib retracement level of the upward move from the $1,659 swing low to $1,738 high. On the downside, there are many supports, starting with the $1,695 zone.

There is also a major bullish trend line forming with support at $1,696 on the same chart. The trend line coincides with the 100 simple moving average (red, 4-hours) at $1,689.

Any further losses may perhaps push gold price towards the $1,680 support. The next key uptrend support is near the $1,630 level or the 200 simple moving average (4-hours, green).

On the upside, an initial resistance is near the $1,730 level and a connecting bearish trend line. A successful close above the trend line could set the pace for a fresh rally towards the $1,750 level in the near term.

Overall, gold price is likely to setting up for the next bullish break above $1,730 as long as it is above $1,680. Looking at major pairs, both EUR/USD and GBP/USD are attempting a decent recovery above key hurdles ahead of the Fed interest rate decision and the US GDP report.

Economic Releases to Watch Today

- Euro Zone Consumer Confidence April 2020 – Forecast -22.7, versus -22.7 previous.

- US Gross Domestic Product Q1 2020 (Preliminary) – Forecast -4.0% versus previous 2.1%.

- Fed Interest Rate Decision - Forecast 0.25%, versus 0.25% previous.