Aayush Jindal

Key Highlights

- USD/CHF started an upside correction from the 0.8985 support zone.

- EUR/USD corrected lower below 1.2120, GBP/USD broke the 1.4100 support zone.

- Crude oil price remains elevated above the $65.00 level.

- The US Initial Jobless Claims could decline from 498K to 490K in the week ending May 8, 2021.

USD/CHF Technical Analysis

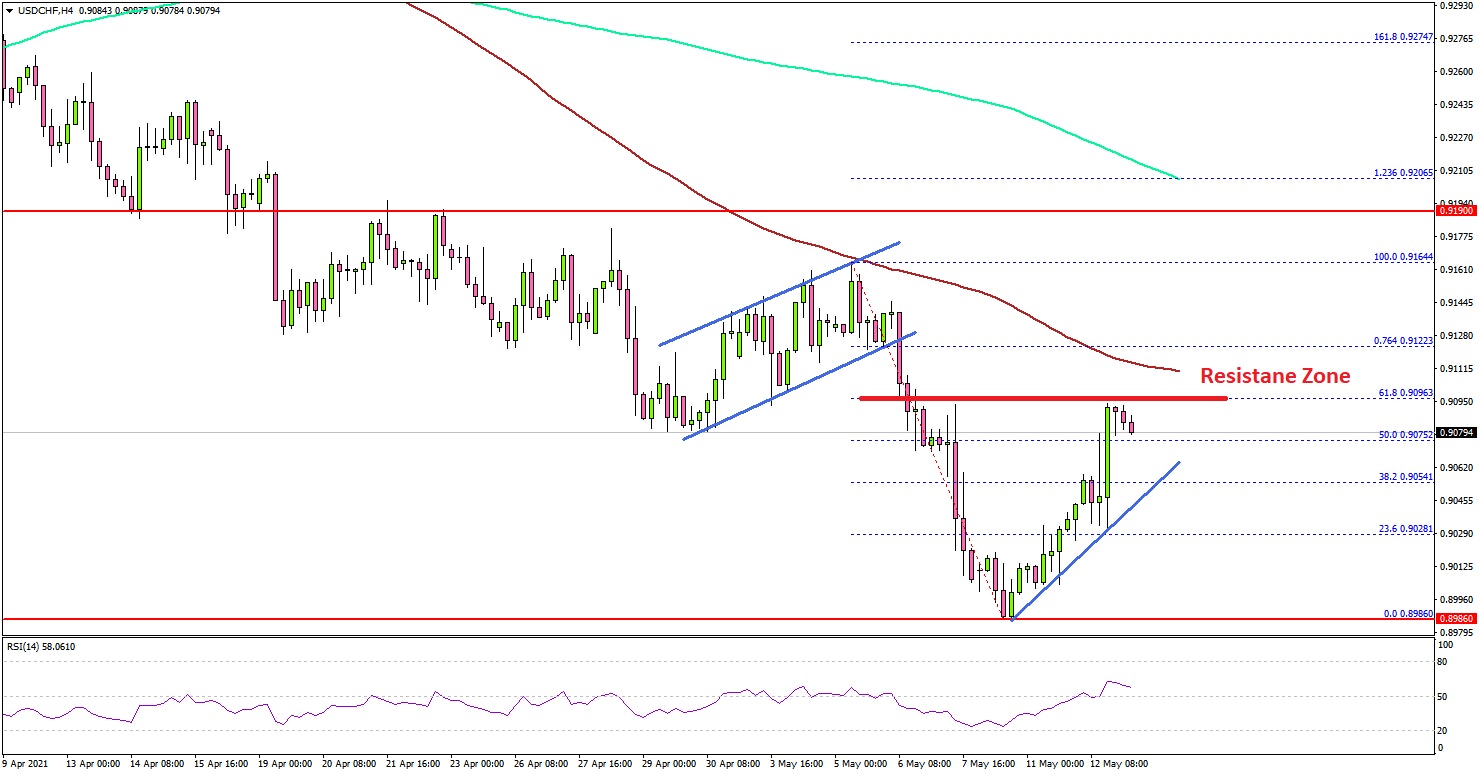

In the past few days, the US Dollar started a steady decline from well above 0.9300 against the Swiss Franc. USD/CHF declined below 0.9200, but it remained supported near 0.8985.

Looking at the 4-hours chart, the pair traded as low as 0.8986 before starting an upside correction. The pair corrected above the 0.9025 and 0.9040 levels.

There was a break above the 50% Fib retracement level of the recent decline from the 0.9164 high to 0.8986 low. On the upside, an immediate hurdle is near the 0.9120 level and the 100 simple moving average (red, 4-hours).

The first major resistance is near the 0.9180 level. The main resistance is near the 0.9200 level and the 200 simple moving average (green, 4-hours).

On the downside, an initial support is near the 0.9025 level. The next key support is near the 0.9000 level, below which the pair could dive further below the 0.8986 low.

Fundamentally, the US Consumer Price Index for April 2021 was released yesterday by the US Bureau of Labor Statistics. The market was looking for an increase of 3.6% compared with the same month a year ago.

The actual result was above the market forecast, as the US Consumer Price Index climbed 4.2% in April 2021. The monthly change was +0.8%, which was above the forecast of 0.2%.

Overall, USD/CHF eyes a steady recovery above the 0.9120 and 0.9150 levels. Besides, EUR/USD and GBP/USD saw a few bearish moves after the release.

Economic Releases

- US Initial Jobless Claims - Forecast 490K, versus 498K previous.

- US Producer Price Index for April 2021 (MoM) – Forecast +0.3%, versus +1.0% previous.

- US Producer Price Index for April 2021 (YoY) – Forecast +5.9%, versus +4.2% previous.