Aayush Jindal

Key Highlights

- USD/JPY extended its decline below the 104.50 support zone.

- A major resistance seems to be forming near 104.50 on the 4-hours chart.

- Gold price is trading well below $1,900 and struggling to recover.

- EUR/USD remained well bid above 1.1820, GBP/USD is facing a strong challenge at 1.3300.

USD/JPY Technical Analysis

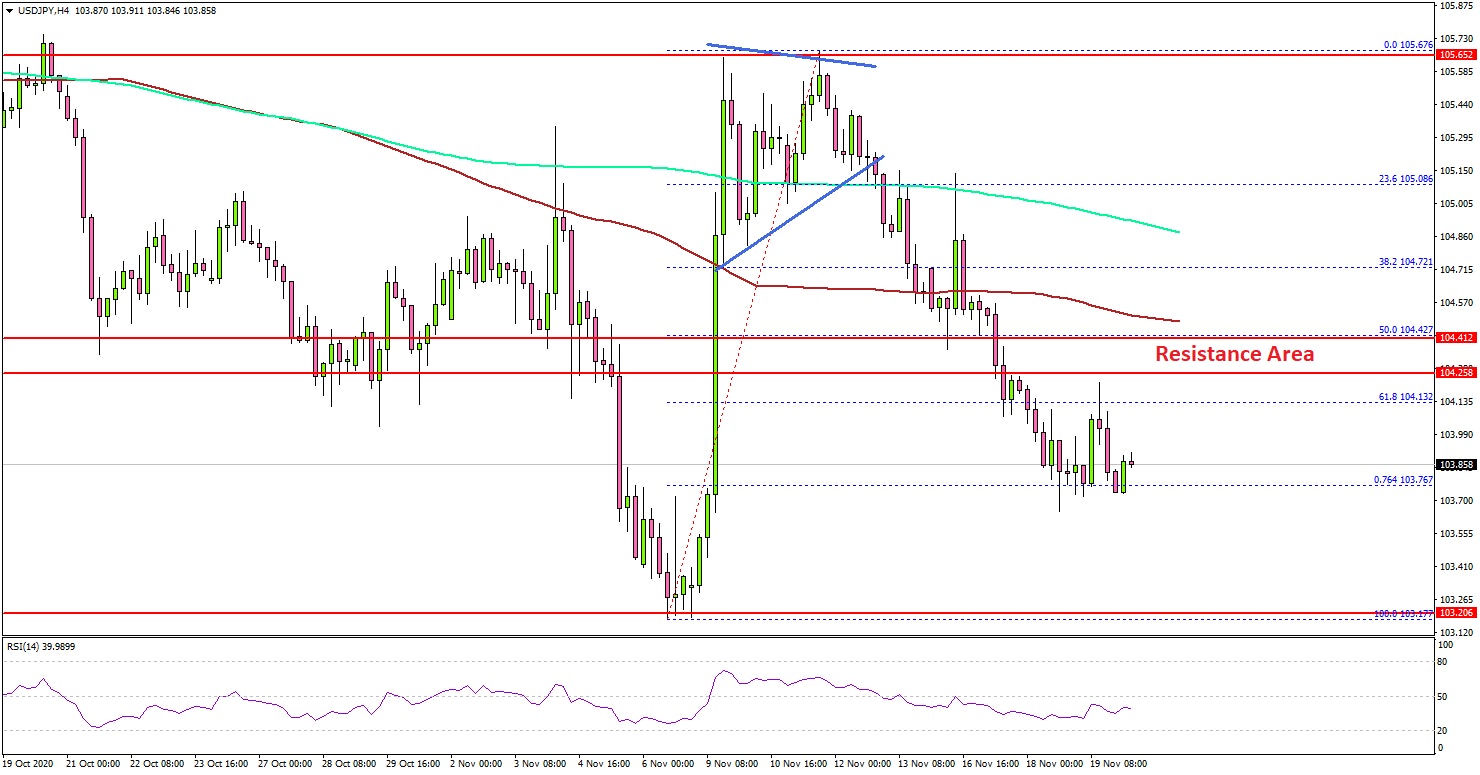

In the past few days, the US Dollar started a steady decline from well above 105.50 against the Japanese Yen. USD/JPY broke the 105.00 support level to move into a bearish zone.

Looking at the 4-hours chart, the pair settled well below the 105.00 pivot level, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

There was a clear break below the 104.50 support level, and the pair even traded below the 61.8% Fib retracement level of the upward move from the 103.17 swing low to 105.67 high. An initial support is seen near the 103.75 level.

It is close to the 76.4% Fib retracement level of the upward move from the 103.17 swing low to 105.67 high. If there is a clear break below 103.75, there is a risk of a sharp decline below the 103.50 support. The next major support is near 103.15.

On the upside, there is a strong resistance forming near the 104.50 and 104.55 levels. To start a fresh increase, the pair must surpass 104.55 and settle above the 100 simple moving average (red, 4-hours).

Fundamentally, the US Initial Jobless Claims report for the week ending Nov 14, 2020 was released yesterday by the US Department of Labor. The market was looking for a minor decline from 709K to 707K.

The actual result was disappointing, as the US Initial Jobless Claims increased to 742K. The last reading was also revised up from 709K to 711K.

The report added:

The 4-week moving average was 742,000, a decrease of 13,750 from the previous week's revised average. The previous week's average was revised up by 500 from 755,250 to 755,750.

Looking at EUR/USD, the pair corrected lower below the 1.1850 support, but stayed above 1.1820. GBP/USD struggled near 1.3300 and it remains at a risk of a downside correction.

Upcoming Economic Releases

- UK Retail Sales Oct 2020 (YoY) - Forecast +4.2%, versus +4.7% previous.

- UK Retail Sales Oct 2020 (MoM) - Forecast 0%, versus +1.5% previous.

- Canadian Retail Sales Sep 2020 (MoM) – Forecast +0.2%, versus +0.4% previous.

- Canadian Retail Sales ex Autos Sep 2020 (MoM) – Forecast +0.2%, versus +0.5% previous.