Aayush Jindal

Key Highlights

- USD/JPY failed to surpass the 104.80 and 105.00 resistance levels.

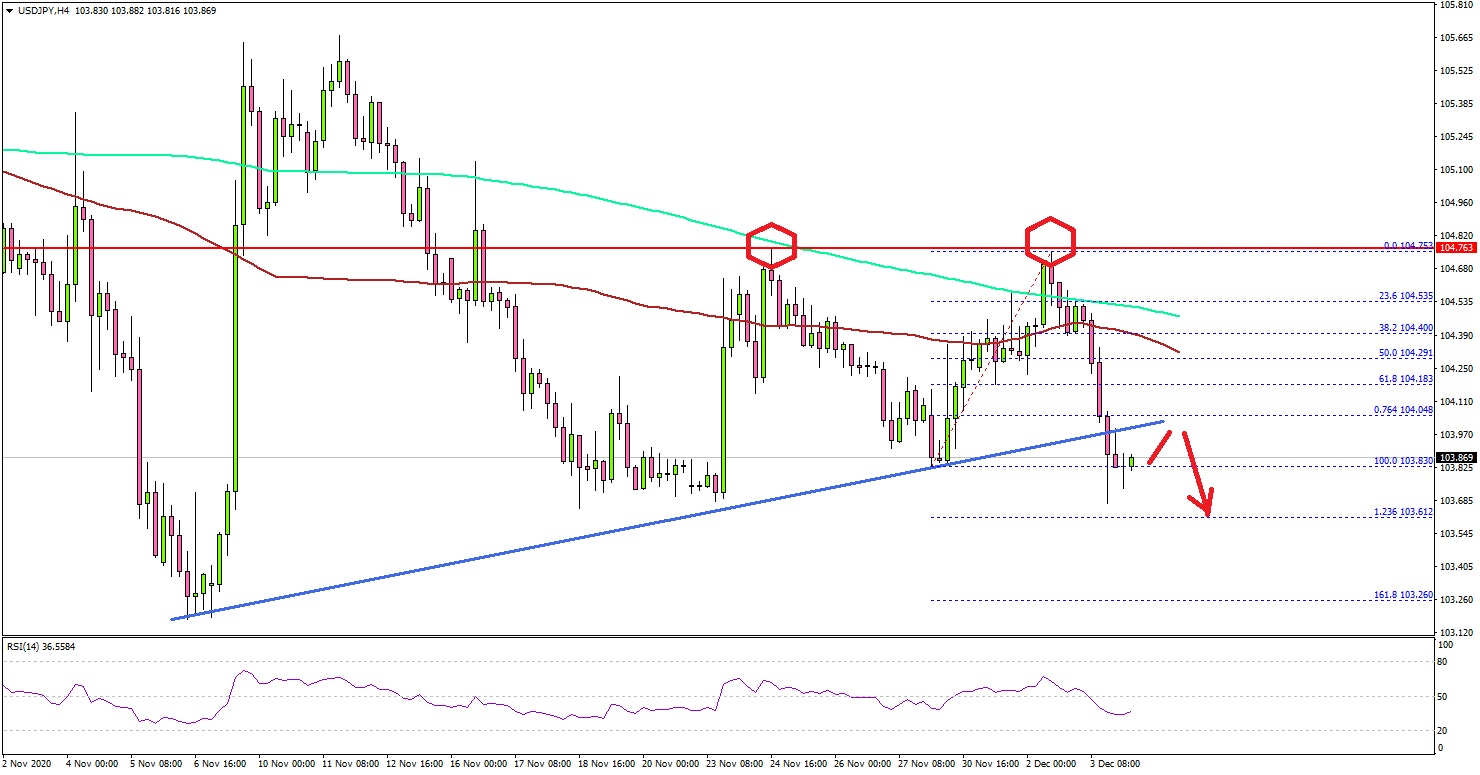

- A double top pattern seems to be forming near 104.75 on the 4-hours chart.

- EUR/USD surged above the 1.2100 and 1.2120 resistance levels, gold price is facing hurdles near $1,850.

- The US nonfarm payrolls (to be released today) could increase 481K in Nov 2020, down from 638K.

USD/JPY Technical Analysis

Earlier this week, the US Dollar climbed higher above the 104.50 resistance against the Japanese Yen. However, USD/JPY failed to surpass the 104.80 and 105.00 resistance levels.

Looking at the 4-hours chart, the pair traded as high as 104.75, and declined below the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

More importantly, it seems like there is a double top pattern forming near 104.75. The pair broke the 50% Fib retracement level of the upward move from the 103.83 low to 104.75 high. An immediate support is near the 104.00 and 103.95 levels.

A successful break and close below the 103.95 level could spark a strong decline. In the stated scenario, the pair could decline towards the 103.25 and 103.00 support levels.

Conversely, the pair could climb higher above the 104.50 resistance. To start a steady increase, the pair must surpass the 104.80 and 105.00 resistance levels.

Fundamentally, the US ISM Non-Manufacturing Index for Nov 2020 was released yesterday by the Institute for Supply Management (ISM). The market was looking for a decline from 56.6 to 56.0.

The actual result was lower than the market forecast, as the US ISM Non-Manufacturing Index declined from 56.6 to 55.9 in Nov 2020.

The report added:

Economic activity in the services sector grew in November for the sixth month in a row. This reading represents a sixth straight month of growth for the services sector, which has expanded for all but two of the last 130 months.

Overall, USD/JPY is showing bearish signs and it could continue to move down towards 103.20. Conversely, there were strong bullish moves in EUR/USD and GBP/USD.

Upcoming Economic Releases

- US nonfarm payrolls Nov 2020 – Forecast 481K, versus 638K previous.

- US Unemployment Rate Nov 2020 - Forecast 6.8%, versus 6.9% previous.

- Canada’s employment Change payrolls Nov 2020 – Forecast 20K, versus 83.6K previous.

- Canada’s Unemployment Rate Nov 2020 - Forecast 8.9%, versus 8.9% previous.