Aayush Jindal

Key Highlights

- USD/JPY started a fresh increase from the 121.20 support zone.

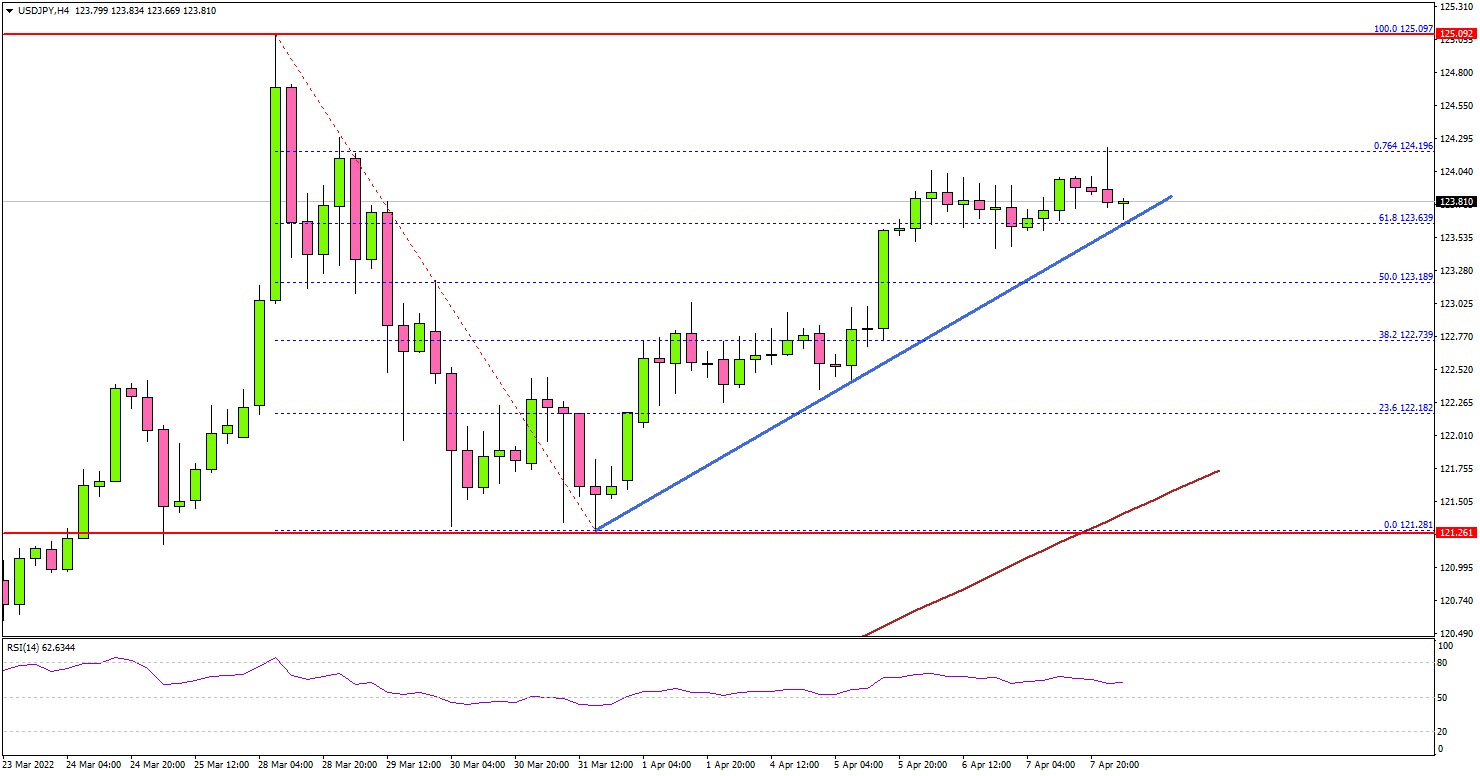

- A key bullish trend line is forming with support near 123.75 on the 4-hours chart.

- EUR/USD started a consolidation phase near the 1.0900 pivot region.

- GBP/USD is showing bearish signs below 1.3150.

USD/JPY Technical Analysis

The US Dollar found a strong support near the 121.20 zone against the Japanese Yen. USD/JPY formed a base and started a fresh increase above the 122.00 level.

Looking at the 4-hours chart, the pair cleared the 122.50 resistance zone, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

There was a clear move above the 50% Fib retracement level of the key decline from the 125.09 swing high to 121.28 low. The pair even settled above the 123.50 level. There is also a key bullish trend line forming with support near 123.75 on the same chart.

If there is a close above the 76.4% Fib retracement level of the key decline from the 125.09 swing high to 121.28 low, the pair could accelerate higher.

The next major resistance is near the 125.00 level. Any more gains might send the pair towards the 126.20 level in the coming sessions.

On the downside, an immediate support is near the 123.75 level. The next major support is near the 122.80 level. A downside break below the 122.80 support level might resend the pair towards the 121.50 level.

Fundamentally, the US Initial Jobless Claims for the week ending April 02, 2022 was released yesterday by the US Department of Labor. The market was looking for a decline from 202K to 200K.

The actual result was better than the forecast, as the US Initial Jobless Claims saw a drop to 166K. Besides, the last reading was revised down to 171K.

The report added:

The previous week's rate was revised up by 0.2 from 0.9 to 1.1 percent. The advance number for seasonally adjusted insured unemployment during the week ending March 26 was 1,523,000, an increase of 17,000 from the previous week's revised level.

Looking at EUR/USD, the pair found support near the 1.0880 zone, but it might struggle to recover above 1.0950. Similarly, GBP/USD might face resistance near 1.3150 and 1.3200.

Economic Releases

- Canada’s employment Change for March 2022 – Forecast 80K, versus 336.6K previous.

- Canada’s Unemployment Rate for March 2022 - Forecast 5.4%, versus 5.5% previous.