Aayush Jindal

Key Highlights

- GBP/USD extended decline below 1.2400 and 1.2300.

- A key bearish trend line is forming with resistance near 1.2540 on the 4-hours chart.

- EUR/USD could continue to move down below 1.0500.

- USD/JPY might extend rally above 131.20 and 131.50.

GBP/USD Technical Analysis

The British Pound started a major decline from the 1.3000 resistance against the US Dollar. GBP/USD settled below the 1.2620 support to move into a bearish zone.

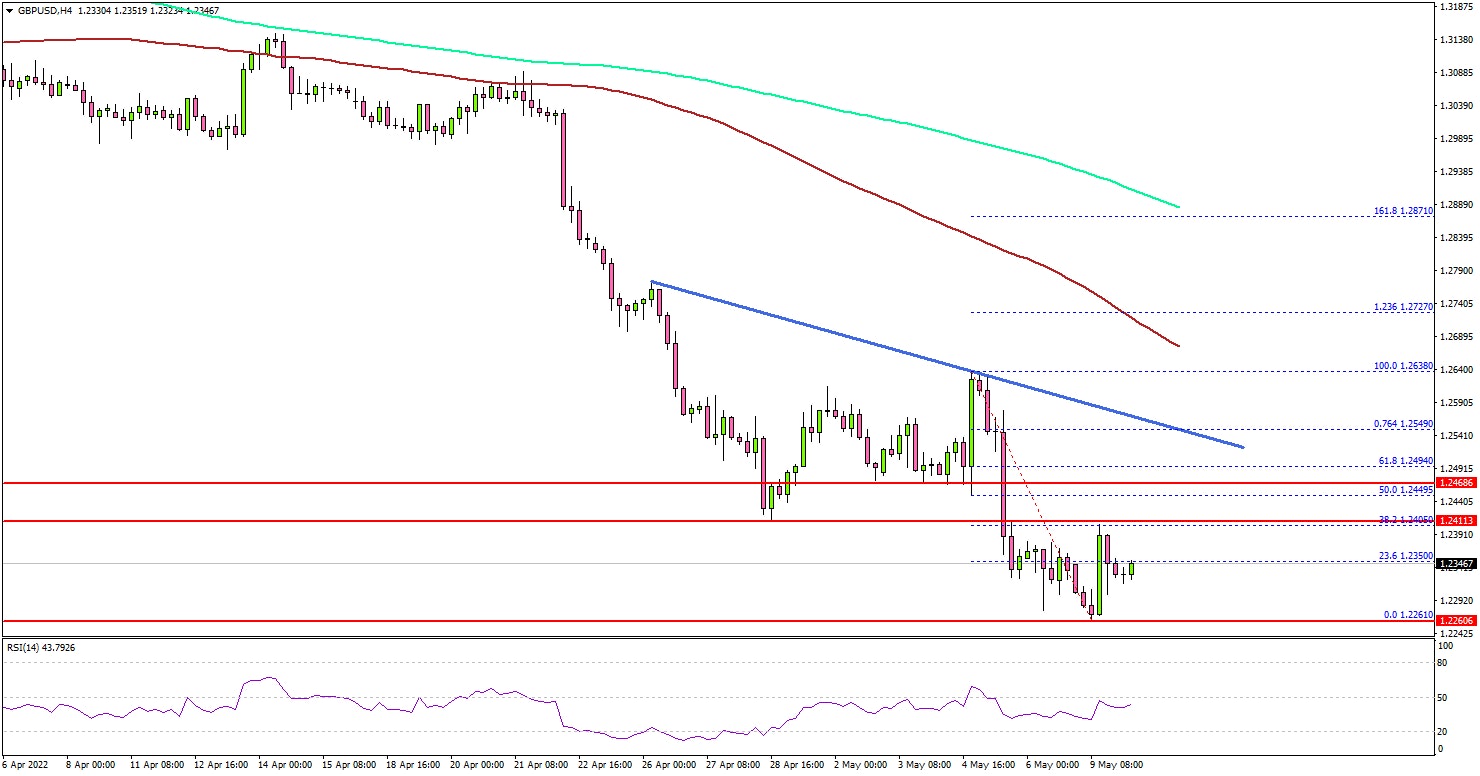

Looking at the 4-hours chart, the pair settled below the 1.2500 level, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

Finally, there was a break below the 1.2300 level and the pair traded as low as 1.2261. Recently, there was a minor upside correction above the 1.2350 resistance level. There a move above the 23.6% Fib retracement level of the recent decline from the 1.2638 swing high to 1.2261 low.

On the upside, an initial resistance is forming near the 1.2450 level. It is near the 50% Fib retracement level of the recent decline from the 1.2638 swing high to 1.2261 low.

The next major resistance is near the 1.2550 zone. There is also a key bearish trend line forming with resistance near 1.2540 on the same chart. If there is an upside break above 1.2550, the pair could accelerate higher towards 1.2700.

If not, there is a risk of more downsides below the 1.2260 level. The next major support is near the 1.2200 level. Any more losses may perhaps push GBP/USD towards the 1.2050 support.

Looking at EUR/USD, the pair is still at a risk of a move below the 1.0400 level. On the upside, the 1.0650 zone is a major hurdle.

Economic Releases

- German ZEW Business Economic Sentiment Index for May 2022 – Forecast -42.5, versus -41 previous.

- Eurozone ZEW Business Economic Sentiment Index for May 2022 – Forecast -41, versus -43 previous.