Aayush Jindal

Key Highlights

- Gold price started a major decline below the $1,750 support zone.

- It is following a key bearish trend line with resistance near $1,712 on the 4-hours chart.

- GBP/USD, AUD/USD and NZD/USD traded to a new multi-week low.

- USD/JPY rallied to a new multi-year high above 139.40.

Gold Price Technical Analysis

Gold price struggled to gain pace above the $1,800 resistance zone against the US Dollar. The price started a major decline below the $1,780 and $1,750 support levels.

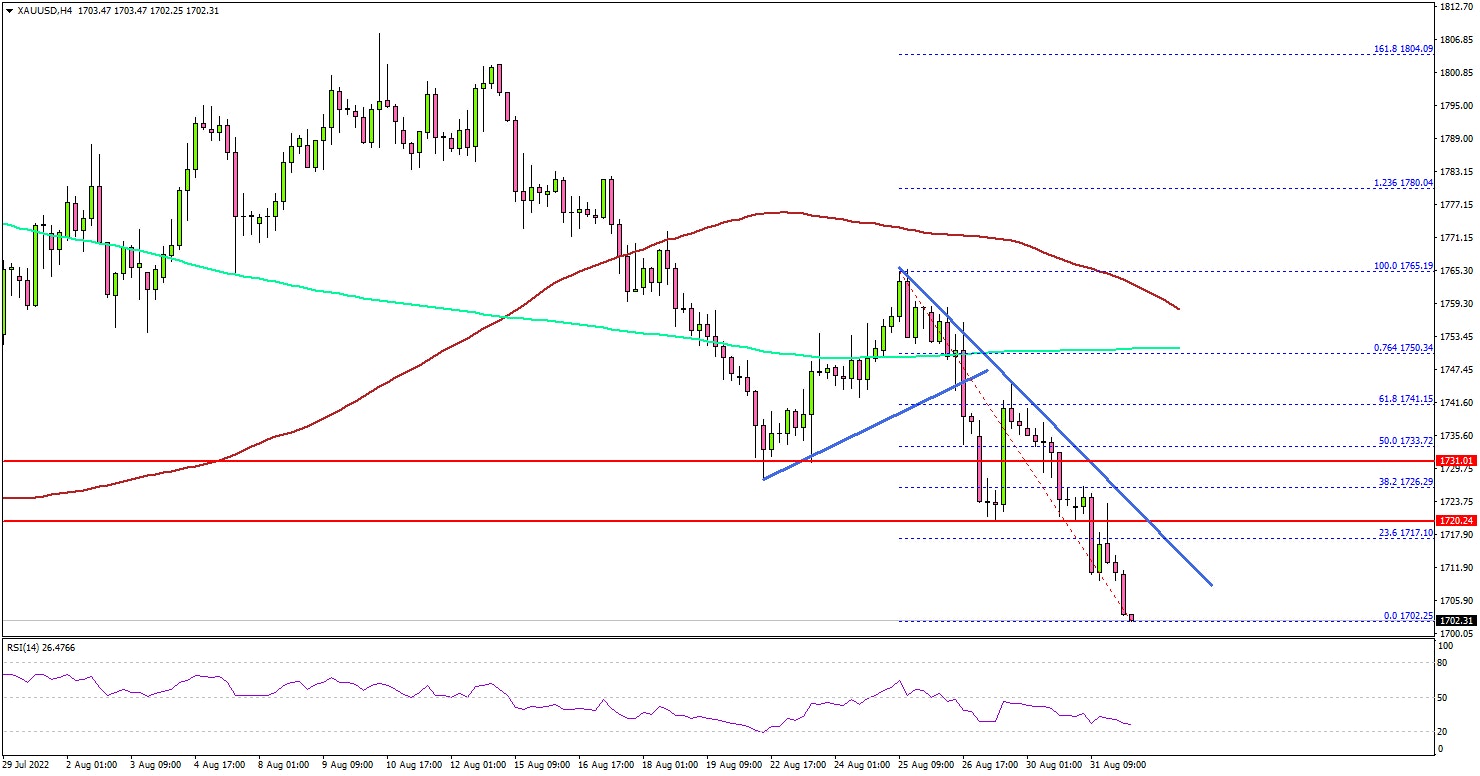

The 4-hours chart of XAU/USD indicates that the price settled below the key $1,750 support, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It opened the doors for more losses below the $1,720 support. The price even traded close to the $1,700 support zone. It seems to be following a key bearish trend line with resistance near $1,712 on the same chart.

On the downside, an initial support is near the $1,700 level. The next major support is near the $1,685 level, below which the price could accelerate lower. In the stated case, the price may perhaps decline towards the $1,660 level.

On the upside, the price might face sellers near the $1,710 level. The next major resistance is near the $1,720 level. Any more gains might send the price towards the $1,732 level.

Looking at GBP/USD, there were additional losses and the pair traded to a new multi-month low below the 1.1600 level.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for August 2022 - Forecast 49.8, versus 49.8 previous.

- Euro Zone Manufacturing PMI for August 2022 – Forecast 49.7, versus 49.7 previous.

- UK Manufacturing PMI for August 2022 – Forecast 46.0, versus 46.0 previous.

- US Manufacturing PMI for August 2022 – Forecast 51.3, versus 51.3 previous.

- US ISM Manufacturing Index for August 2022 – Forecast 52.0, versus 52.8 previous.

- US Initial Jobless Claims - Forecast 248K, versus 243K previous.