Aayush Jindal

Key Highlights

- Gold price started a fresh decline and traded below $1,850.

- A key bearish trend line is forming with resistance near $1,875 on the 4-hours chart.

- EUR/USD is struggling below 1.0640, and GBP/USD is facing an uphill task near 1.2500.

- The US Consumer Price Index could increase 8.1% in for April 2022 (YoY).

Gold Price Technical Analysis

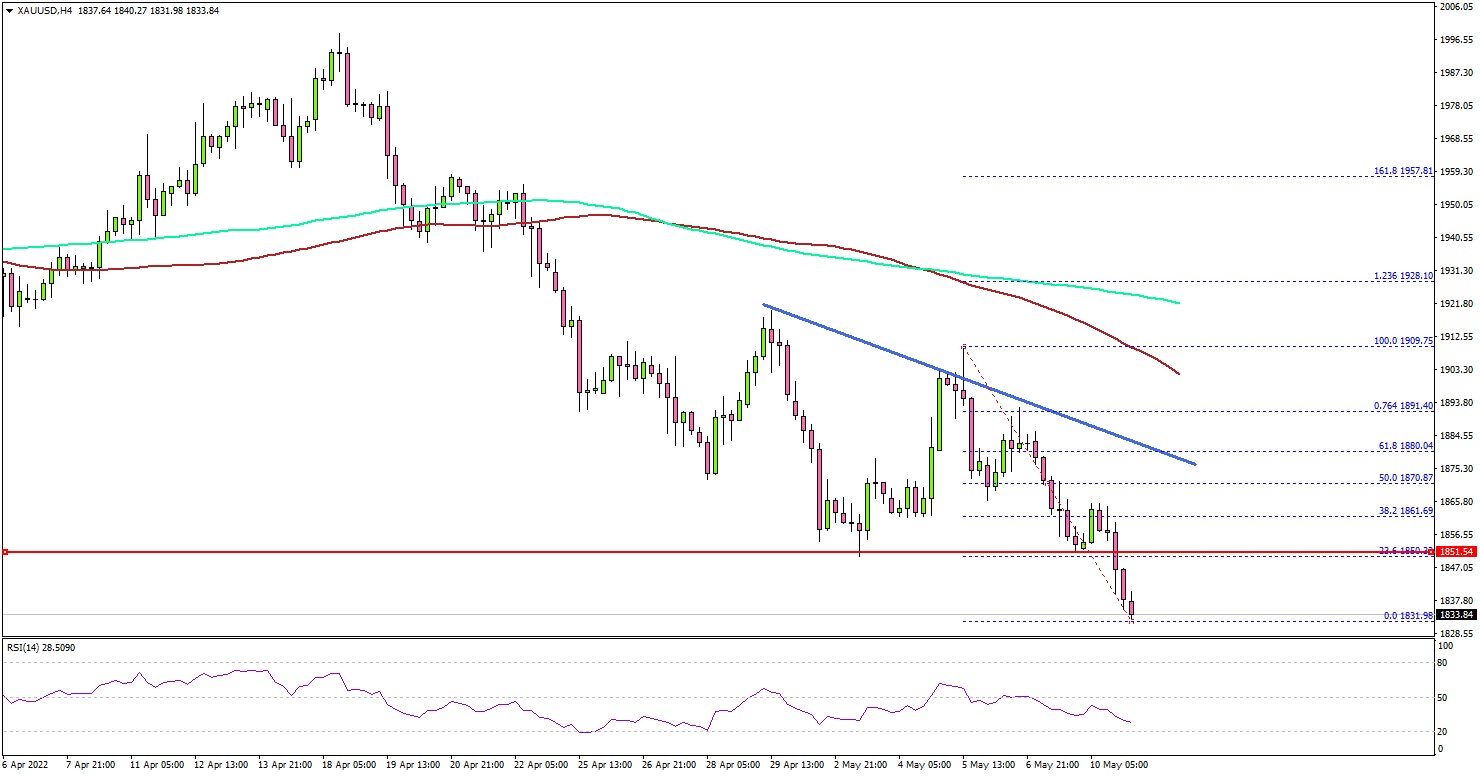

Gold price struggled to clear the $1,920 resistance zone against the US Dollar. The price extended decline below the $1,900 support and moved into a short-term bearish zone.

The 4-hours chart of XAU/USD indicates that the price traded below the $1,880 support zone. There was also a move below the $1,865 level, and the price settled below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

It retested the key $1,835 support area, where the bulls emerged. It is now consolidating losses above $1,835. On the upside, the price might face resistance near $1,850.

The next key resistance could be $1,875. There is also a key bearish trend line forming with resistance near $1,875 on the same chart. A clear move the trend line and $1,880 might send the price towards the 100 simple moving average (red, 4-hours).

If there is no upward move, the price could decline below the $1,835 support. The next major support is near the $1,820 level, below which it could even test $1,800.

Looking at EUR/USD, the pair is still trading in a bearish zone below the 1.0640 level. Similarly, GBP/USD is struggling to rise above 1.2500.

Economic Releases to Watch Today

- German Consumer Price Index for April 2022 (YoY) – Forecast +7.4%, versus +7.4% previous.

- German Consumer Price Index for April 2022 (MoM) – Forecast +0.8%, versus +0.8% previous.

- US Consumer Price Index for April 2022 (MoM) – Forecast +0.2%, versus +1.2% previous.

- US Consumer Price Index for April 2022 (YoY) – Forecast +8.1%, versus +8.5% previous.

- US Consumer Price Index Ex Food & Energy for April 2022 (YoY) – Forecast +6%, versus +6.5% previous.