Aayush Jindal

Key Highlights

- USD/JPY started a downside correction from 139.40.

- It is facing resistance near 138.80 and 139.00 on the 4-hours chart.

- EUR/USD is struggling near 1.0280, and GBP/USD failed to surpass 1.2040.

- Gold price extended losses and spiked below $1,700.

USD/JPY Technical Analysis

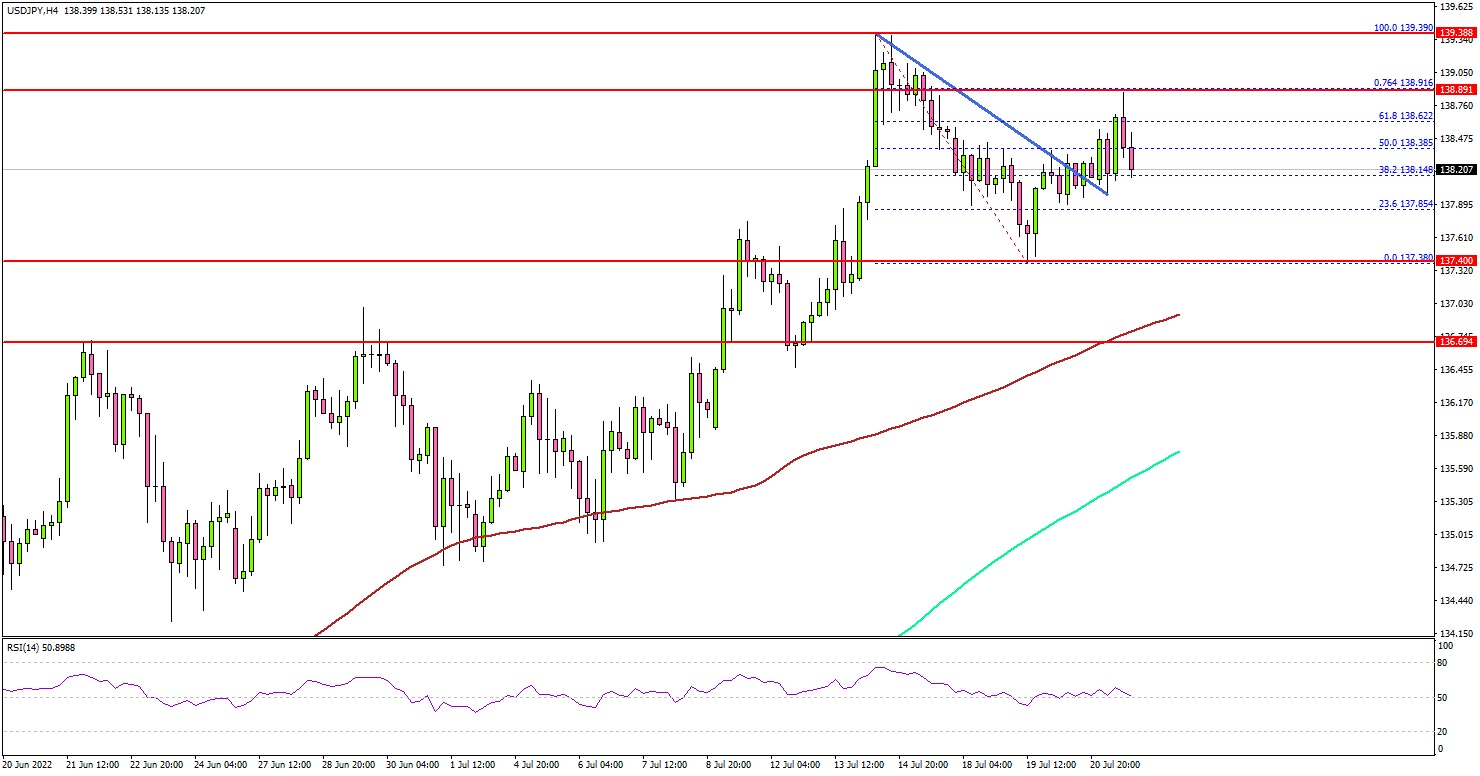

The US Dollar traded to a new multi-year high at 139.39 against the Japanese Yen before correcting lower. USD/JPY is now trading below 139.00 and showing signs of a downside correction.

Looking at the 4-hours chart, the pair dipped once below the 138.00 level but remained well above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

It traded as low as 137.38 and is currently consolidating near 138.50. On the upside, the pair is now facing resistance near the 138.80 level. The next major resistance is near 139.00. If there is an upside break, the pair could rise towards 140.00.

The next major resistance could be near the 141.20 level, above which the pair could rise to 142.00. If there is no upside break, the pair could correct lower and dip below 137.80.

The next major support is 137.40, below which the pair could resume its decline. In the stated case, the pair might decline towards the 136.50 level.

Looking at gold price, there was a sharp decline below the $1,700 level before the bulls appeared. On the upside, the bears might remain active near $1,720 or $1,725.

Economic Releases

- Germany’s Manufacturing PMI for July 2022 (Preliminary) - Forecast 50.6, versus 52.0 previous.

- Germany’s Services PMI for July 2022 (Preliminary) - Forecast 51.2, versus 52.4 previous.

- Euro Zone Manufacturing PMI for July 2022 (Preliminary) – Forecast 51.0, versus 52.1 previous.

- Euro Zone Services PMI for July 2022 (Preliminary) – Forecast 52.0, versus 53.0 previous.

- UK Manufacturing PMI for July 2022 (Preliminary) – Forecast 52.0, versus 52.8 previous.

- UK Services PMI for July 2022 (Preliminary) – Forecast 53.0, versus 54.3 previous.

- US Manufacturing PMI for July 2022 (Preliminary) – Forecast 52.0, versus 52.7 previous.

- US Services PMI for July 2022 (Preliminary) – Forecast 52.6, versus 52.7 previous.