Aayush Jindal

Key Highlights

- Crude oil price found support near $97.50 and climbed higher.

- A key bullish trend line is forming with support near $99.20 on the 4-hours chart.

- Gold price is still struggling below $1,880 and $1,900.

- EUR/USD is consolidating below 1.0600, and GBP/USD extended losses below 1.2250.

Crude Oil Price Technical Analysis

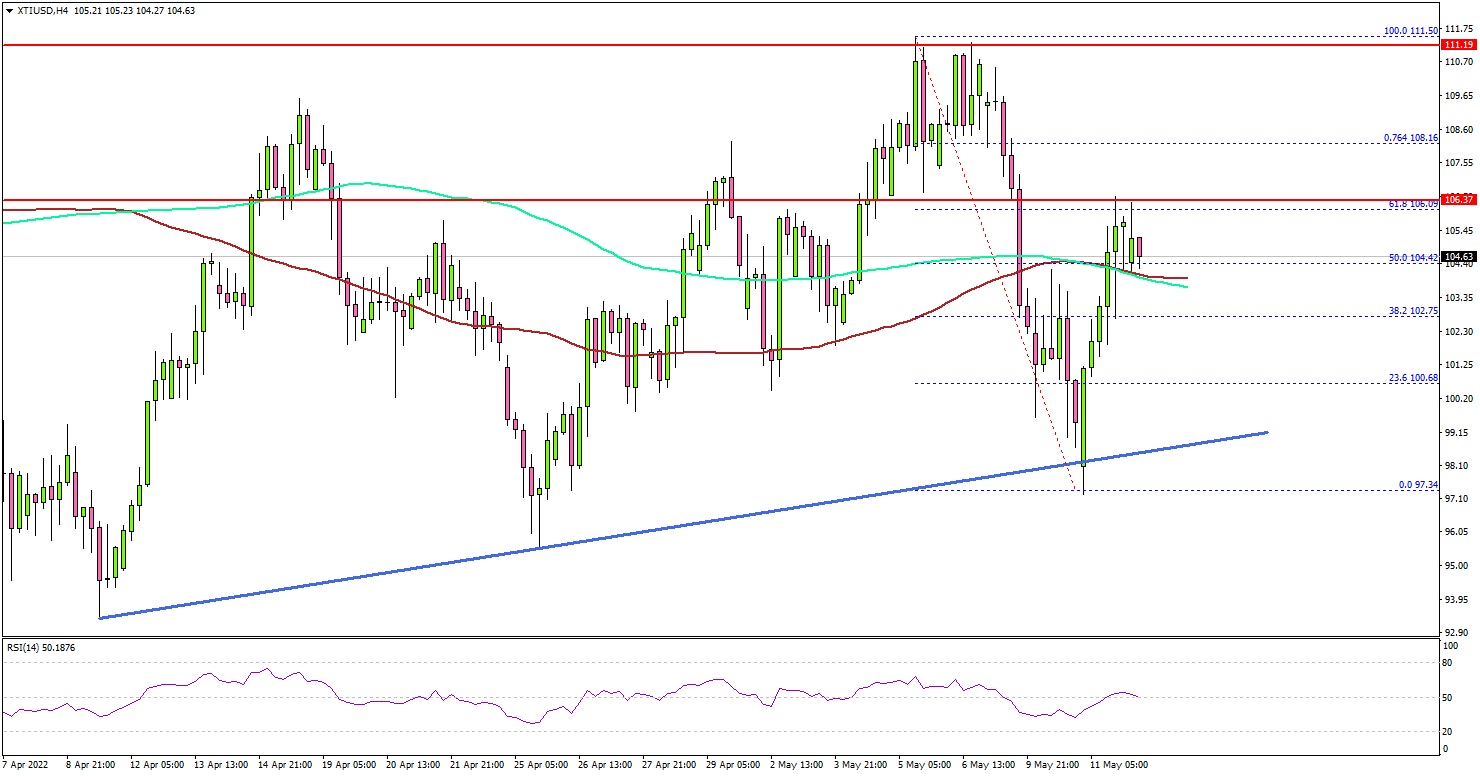

After facing rejection near $111.50, crude oil price started a fresh decline against the US Dollar. The price traded below the $105 support to move into a short-term bearish zone.

Looking at the 4-hours chart of XTI/USD, the price traded below the $100 support, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It traded as low as $97.34 before the bulls appeared. The price started a fresh upward move above the $100 and $102 levels. There is also a key bullish trend line forming with support near $99.20 on the same chart.

The price climbed above $104.50 and the 50% Fib retracement level of the downward move from the $111.50 swing high to $97.34 low.

It is now facing resistance near the $106.40 level. It is close to the 61.8% Fib retracement level of the downward move from the $111.50 swing high to $97.34 low. A clear move above the $106.40 resistance zone could open the doors for a steady move towards the $110 resistance level. The next major resistance might be near the $112 level.

If there is no upside break, the price could start another decline below $102. The next major support is near $100, below which there is a risk of a move towards the $95.50 level. Any more losses might call for a test of the $92 support.

Looking at the gold price, the bears remained active below the $1,900 level. A close below $1,840 and $1,830 might spark more losses.

Economic Releases to Watch Today

- UK GDP for Q1 2022 (QoQ) (Prelim) - Forecast +1%, versus +1.3% previous.

- US Initial Jobless Claims - Forecast 195K, versus 200K previous.