Nick Goold

How to Start Copy Trading as a Follower: A Step-by-Step Guide

Copy trading allows both beginners and experienced investors to automatically replicate the strategies of professional traders. This guide explains how to start copy trading as a follower, covering the importance of choosing the right platform, evaluating trader performance, and building a sustainable long-term strategy. With the right preparation, copy trading can be both an educational tool and a profitable investment approach.

Understanding the Copy Trading Landscape

Copy trading creates a symbiotic relationship between professional traders and followers. Experienced traders execute trades, while followers replicate those trades in real time. This setup provides the dual benefit of potential profits and practical education, as followers can learn trading psychology, risk management, and strategy implementation by observing professionals.

Mastering Trading Terminologies Before You Start

Before diving into copy trading, it’s essential to understand the trading jargon. Key terms include:

- Market, Limit, and Stop Orders – basic order types for trade execution.

- Trailing Stop – an order that adjusts automatically as the market moves in your favor.

- Technical Indicators – such as Moving Averages, Bollinger Bands, RSI, and MACD.

Understanding whether a trader uses trend-following or range-trading strategies will help you better evaluate their system and decide if it fits your trading goals.

Surveying Platforms for Copy Trading

Not all copy trading platforms are equal. Look for platforms that combine:

- User-friendly tools and easy setup

- Transparent performance statistics

- Strong regulatory oversight for fund safety

- A supportive trading community

Choosing the Right Platform

The platform you choose will determine your overall copy trading experience. A good platform should align with your trading objectives, risk appetite, and ease of use.

Popular Platforms

MT4/MT5: Long-trusted platforms in the forex industry, MT4 and MT5 allow traders to install Expert Advisors (EAs) that replicate trades automatically.

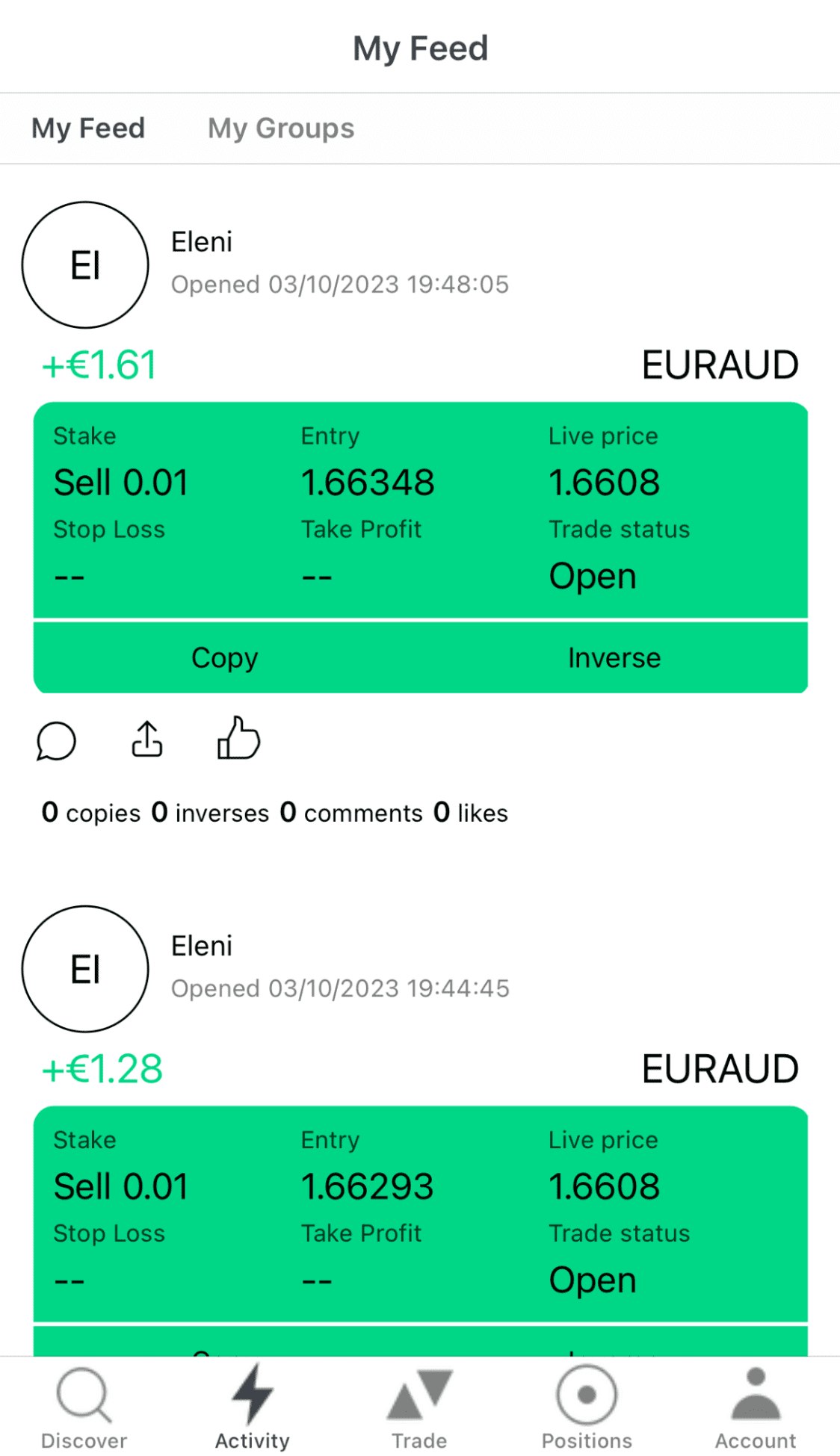

Titan FX Social: Integrated with MT4/MT5 accounts, Titan FX Social makes copy trading seamless. Within the app, you can browse top traders, review their strategies, and follow them with a single click. Trades are automatically copied, minimizing manual work and reducing entry barriers.

How to Choose the Best Trader to Follow

Once your platform is ready, the next critical step is choosing a trader to copy. Focus on performance quality, risk management, and consistency rather than chasing short-term high profits.

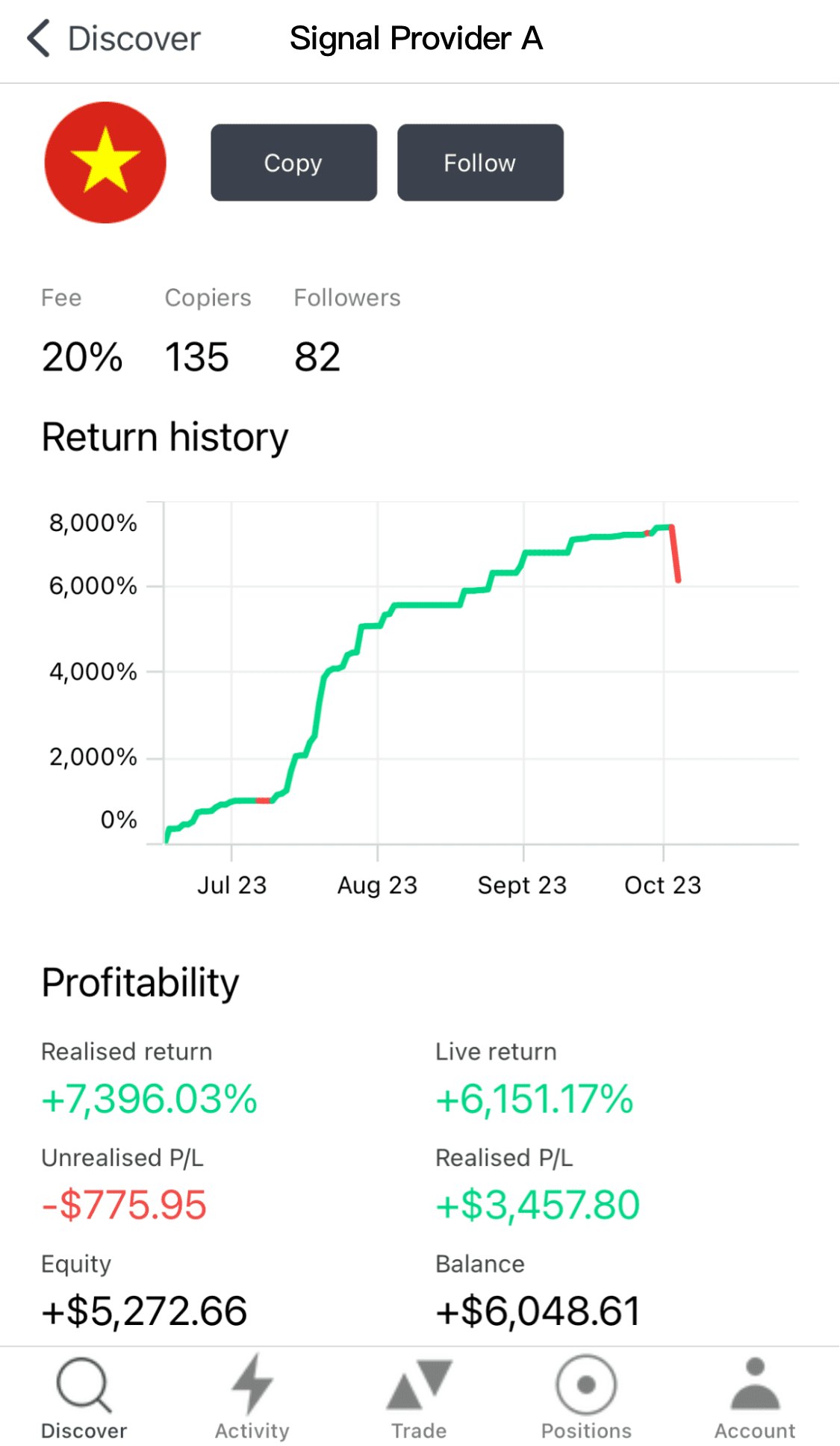

1. Analyzing Past Performance

- Consistency: Look for long-term stability over flashy short-term gains.

- Recovery from Losses: How quickly does the trader bounce back from drawdowns?

- Risk Management: Avoid traders who double down after losses or risk inconsistent amounts per trade.

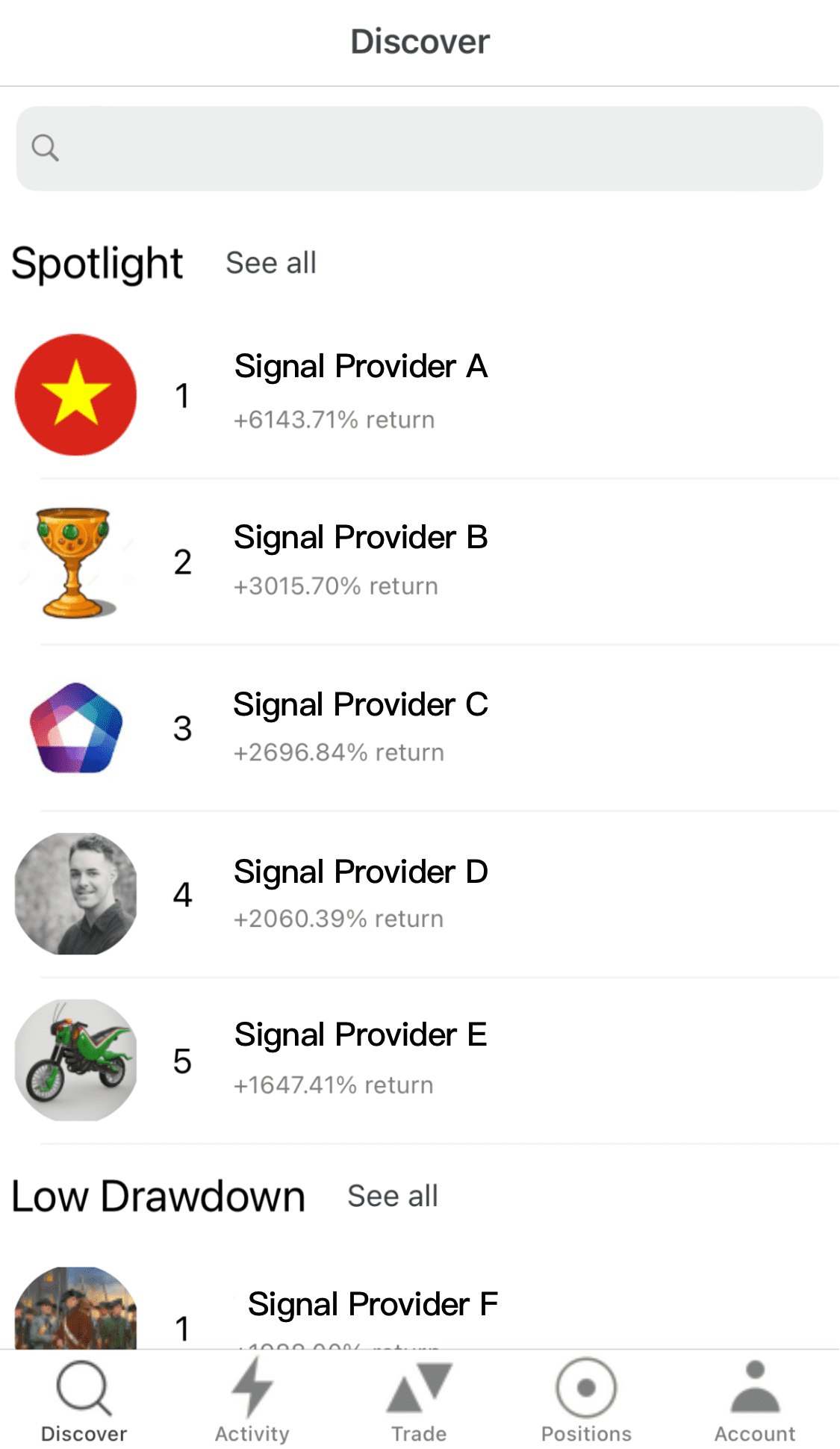

The Titan FX Social App includes a performance scoreboard where you can compare top traders easily.

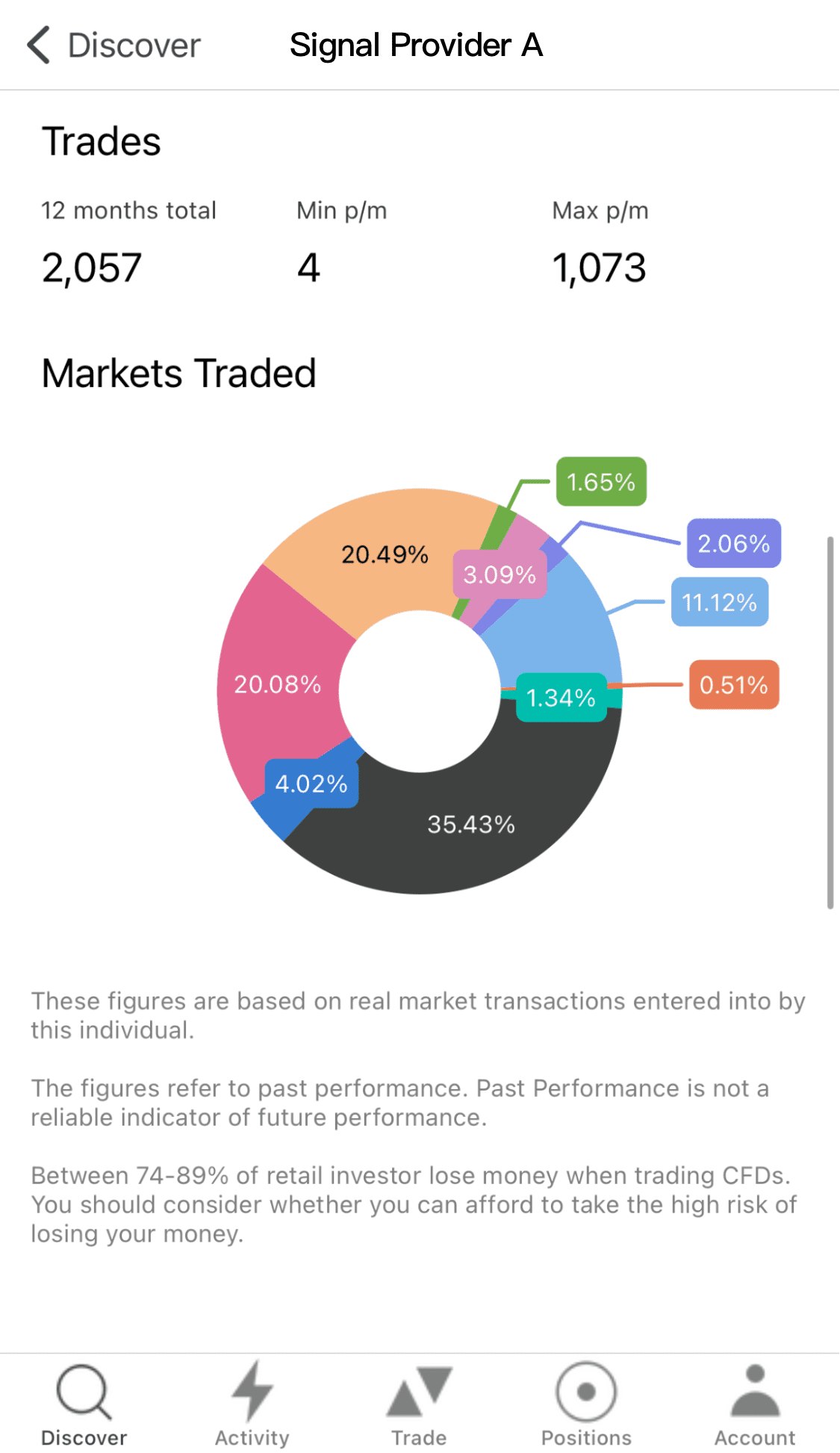

For example, one trader on the platform displayed consistent results across 2,000+ trades in multiple markets, demonstrating adaptability and risk control. These insights give followers a more complete view of potential strategies. (Note: This is only an example. Please conduct your own research before choosing a trader.)

2. Understanding Trading Style

Check if a trader’s performance came from trending or ranging markets. This helps you judge if their strategy is likely to work in future conditions.

3. Grasping System Logic

Using the Titan FX Social app, you can review ongoing trades and analyze their logic before copying.

(Note: We are not recommending this trader. Always research independently.)

4. Expertise and Specialization

Professional traders often specialize in a limited number of strategies. This focus may lead to more reliable results compared to traders who spread themselves too thin.

5. Community Interaction

Reliable traders are often active in the trading community, answering questions and sharing insights. This openness can be a strong indicator of credibility.

Getting Started with Copy Trading

Account Setup and Investment Allocation

When funding your account, only invest money you are prepared to lose. Start with small amounts until you gain confidence in the system.

Ongoing Portfolio Monitoring

Copy trading isn’t entirely passive. Monitor your portfolio regularly to assess trader performance and make adjustments as needed, especially when market conditions shift.

Tips for Sustainable Copy Trading

Commit to Continuous Learning

Use copy trading as an opportunity to learn. Study how top traders manage entries, exits, and risk. Over time, this knowledge can help you build your own strategy.

Diversify and Manage Risk

Avoid putting all your capital behind a single trader. Diversify across different traders, systems, and markets. Combining multiple strategies can lead to more consistent performance and reduced risk.

Conclusion

Starting copy trading as a follower requires careful platform selection, trader evaluation, and ongoing monitoring. When done correctly, it offers both financial opportunities and valuable trading education. Approach it with patience, diversify your risks, and use it as a stepping stone to becoming a more confident and independent trader.

Download for iOSDownload for Android

Related Copy Trading Articles

- Copy Trading Guide 1: How to Start Copy Trading as a Follower?

- Copy Trading Guide 2: The Benefits of Copy Trading at Titan FX

- Copy Trading Guide 3: How to Start Copy Trading with Titan FX?

- The Downsides of Copy Trading: How to Sidestep Common Pitfalls

- Thriving in the Copy Trading World: A Guide to Sustainable Profits