Nick Goold

The Downsides of Copy Trading: How to Avoid the Biggest Pitfalls

Copy trading, where retail traders mirror the trades of experienced investors, is often marketed as an easy way to enter the forex and CFD markets. While it offers convenience and the potential to profit without years of training, copy trading also comes with significant risks that many beginners overlook. Understanding these downsides — and knowing how to avoid them — is essential if you want to use copy trading successfully.

Difficulty in Identifying Reliable Traders

One of the biggest challenges in copy trading is choosing the right trader to follow. Platforms often highlight traders with high short-term profits, but these results may be due to luck or risky strategies that aren’t sustainable long term. Many new traders fall into the trap of following someone who had one strong month, only to lose money when the strategy fails.

How to Avoid It: Carefully analyze a trader’s historical performance, risk-to-reward ratio, drawdown history, and consistency over time. Start with a small position size when following a new trader and gradually increase it as you gain confidence in their approach.

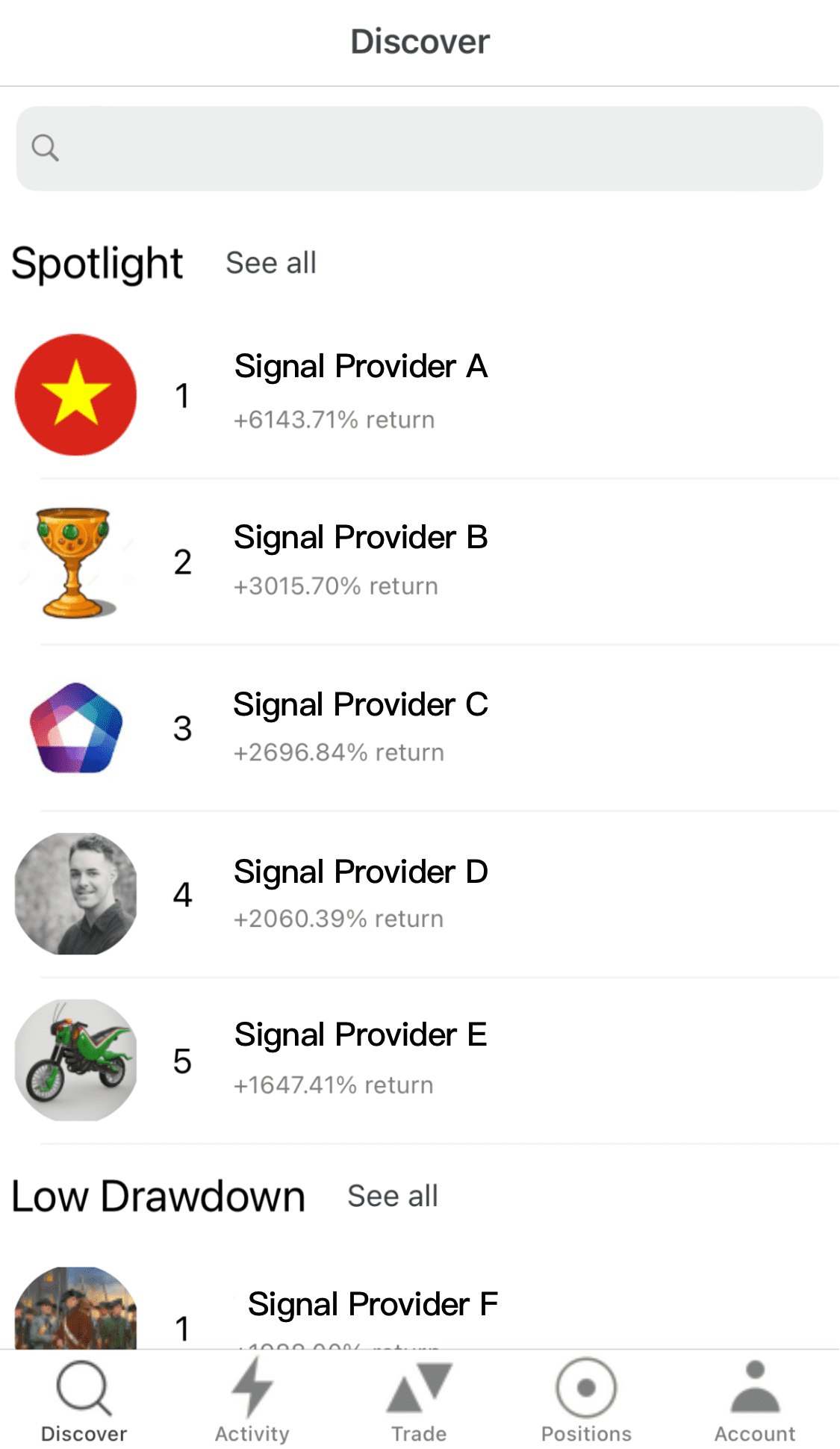

With the Titan FX Social scoreboard, you can easily review and compare the performance of multiple traders before committing capital.

Risk of Traders Stopping Suddenly

Another major downside is that a trader you follow may suddenly stop trading or take long breaks, leaving you without active signals. If you rely on just one trader, your account could sit idle or miss opportunities.

How to Avoid It: Diversify by following multiple traders across different strategies. This ensures that even if one trader takes a break, your account continues to benefit from others’ activity, reducing overall risk.

Limited Learning Opportunities

While copy trading can generate profits, it does little to help you grow as a trader. If you only copy without analyzing, you miss the chance to understand market dynamics and improve your skills.

How to Avoid It: Combine copy trading with educational resources and market analysis. Study why a trader enters and exits positions. Over time, this can help you develop your own trading strategies rather than relying solely on others.

Hidden and Performance Fees

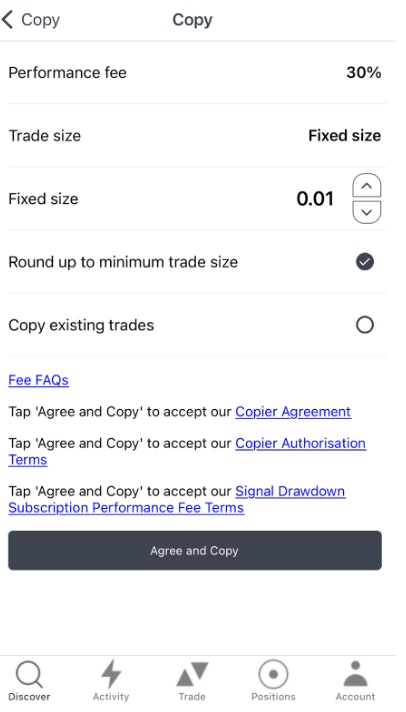

Copy trading often involves performance fees or copier fees that reduce your net profits. Even if the trader performs well, fees can eat into your returns and lower your actual gains.

How to Avoid It: Always check the fee structure before copying a trader. On the Titan FX Social app, you can easily compare providers’ fees to ensure you know your true net return after costs.

Emotional Challenges for Copiers

One reason traders turn to copy trading is to reduce emotional decision-making. However, it doesn’t completely eliminate emotions. Followers may still feel anxious during volatile markets, second-guess the trader’s choices, or panic when trades go against them.

How to Avoid It: Maintain a long-term mindset and prepare mentally for both wins and losses. Journaling your reactions and, if necessary, seeking guidance from trading psychology resources can help build resilience.

Technology and Platform Risks

Since copy trading relies on online platforms, technology issues such as server downtime, internet outages, or software glitches can cause problems. Missed trades or delayed signals may negatively impact your account.

How to Avoid It: Choose platforms with reliable infrastructure and strong customer support. Always have a backup plan to manually manage trades if the copy system fails temporarily.

Final Thoughts: Smarter Copy Trading

Copy trading can be a useful tool for new and busy traders, but it is not risk-free. By carefully selecting reliable traders, diversifying across strategies, monitoring fees, and managing emotions, you can significantly improve your results. Remember, the key to long-term success in forex and CFD trading is not just about following others but about understanding the risks and managing them wisely.

Related Copy Trading Articles

- Copy Trading Guide 1: How to Start Copy Trading as a Follower?

- Copy Trading Guide 2: The Benefits of Copy Trading at Titan FX

- Copy Trading Guide 3: How to Start Copy Trading with Titan FX?

- The Downsides of Copy Trading: How to Sidestep Common Pitfalls

- Thriving in the Copy Trading World: A Guide to Sustainable Profits