Nick Goold

Thriving in the Copy Trading World: A Guide to Sustainable Profits

Copy trading has become one of the most popular ways for new and experienced traders to participate in the financial markets. By automatically mirroring the trades of skilled investors, followers can aim to replicate success without managing every decision themselves. However, many newcomers face pitfalls such as unrealistic expectations, poor trader selection, and lack of diversification. This article explores the common challenges of copy trading and provides strategies to build a more sustainable and profitable approach.

Why Some Traders Fail to Profit from Copy Trading

Despite its appeal, many traders struggle to generate consistent profits from copy trading. Key reasons include starting too quickly, expecting guaranteed profits, or relying blindly on past performance. Understanding these challenges is the first step toward avoiding them.

Start Slow: Building a Strong Foundation

Entering copy trading with the expectation of fast profits often leads to disappointment. A cautious approach — starting small, testing strategies, and gradually increasing exposure — helps traders learn how markets behave and how professional traders adapt to changing conditions.

Avoid Unrealistic Expectations

Even the best traders face losing periods. Instead of expecting non-stop profits, focus on identifying traders with strong risk management skills who can adapt strategies to changing market conditions. Long-term consistency matters far more than short-term gains.

Common Pitfalls to Watch Out For

- Lack of Diversification: Don’t put all your funds into copying a single trader. Spread your risk by following multiple traders with different strategies and assets.

- Relying Only on Past Performance: Past results can be useful, but they don’t guarantee future returns. Always review risk metrics and trading style.

- Blind Following: Understand the logic behind a trader’s strategy before copying. Knowledge builds confidence and reduces risk.

How to Start Copy Trading Safely

Before risking real money, practice with a demo account to learn how trades are executed. Once comfortable, choose a regulated and reputable platform like Titan FX Social, which provides performance data and risk controls. Diversify across multiple traders, monitor your portfolio regularly, and be ready to adjust based on market conditions.

Strategies for Sustainable Copy Trading

Commit to Ongoing Education

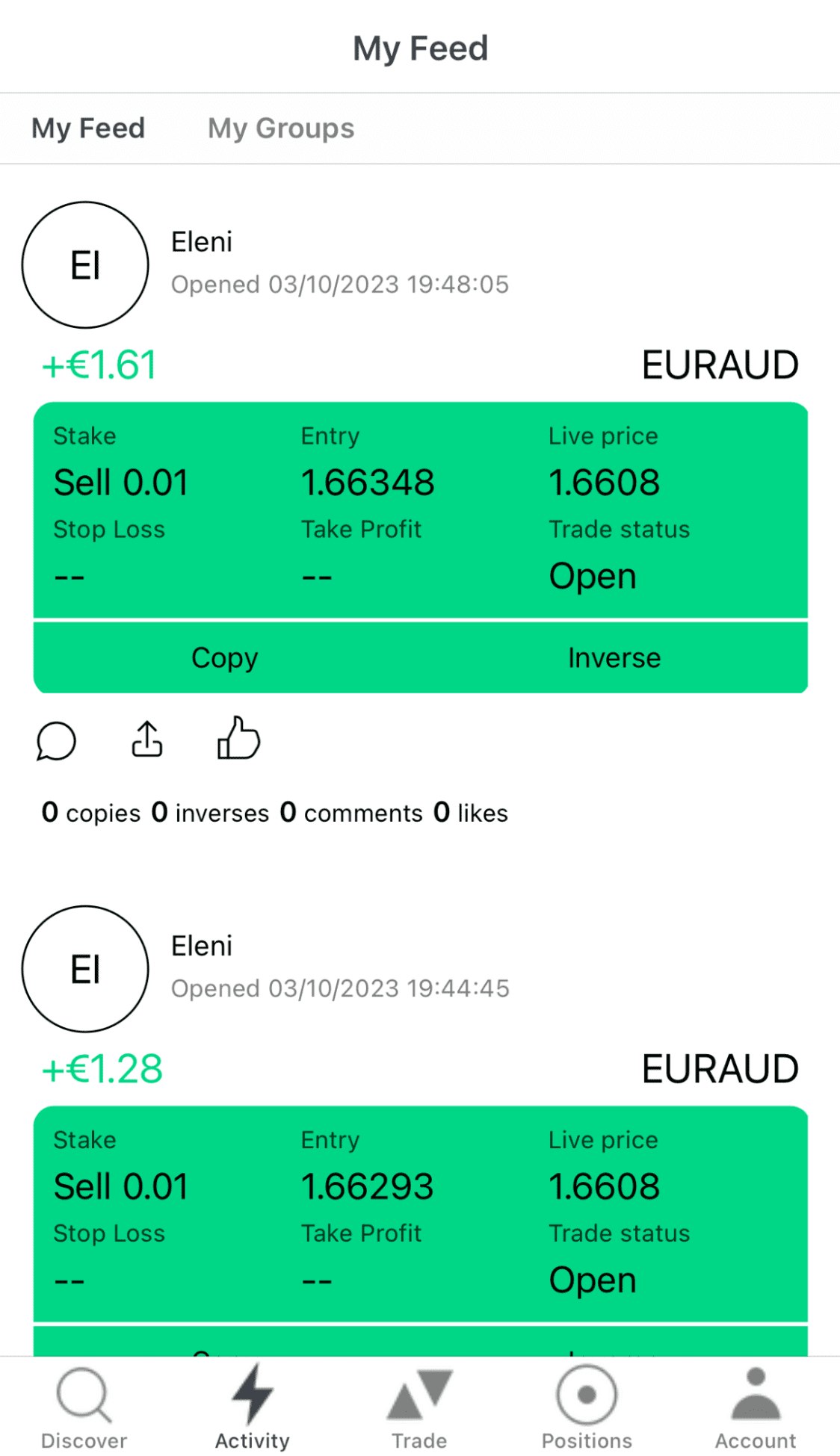

Copy trading is both a learning and earning tool. Observe how professional traders react to news, manage risk, and adapt to market shifts. The Titan FX Social app allows you to track traders’ performance before deciding to copy them, giving you valuable insights into their strategies.

Legal and Safety Considerations

Always use regulated platforms and understand the legal framework of copy trading. This helps protect your funds from fraud or scams and ensures you trade in a secure environment.

Seek Flexible and Adaptable Traders

The most sustainable traders are those who can adjust strategies when markets change. Look for traders who manage risk well and have proven adaptability across different market conditions.

Stay Emotionally Balanced

Copy trading doesn’t eliminate emotional challenges. Market volatility can cause stress, so maintaining calm and rational decision-making is essential. Avoid impulsive changes and stick to your strategy.

Leverage Technology

Understanding the technology behind copy trading platforms helps you set up filters, monitor performance, and manage risks more effectively. Proficiency in using these tools can improve your long-term results.

Conclusion

Succeeding in copy trading requires more than blindly following others — it demands education, diversification, emotional control, and continuous monitoring. By approaching copy trading with realistic expectations and a focus on long-term growth, you can transform it from a gamble into a sustainable strategy for financial success.

Related Copy Trading Articles

- Copy Trading Guide 1: How to start copy trading as a follower?

- Copy Trading Guide 2: The Benefits of Copy Trading at Titan FX

- Copy Trading Guide 3: How to Start Copy trading with Titan FX?

- The Downsides of Copy Trading: How to Sidestep Common Pitfalls

- New Thriving in the Copy Trading World: A Guide to Sustainable Profits Article